Market Share

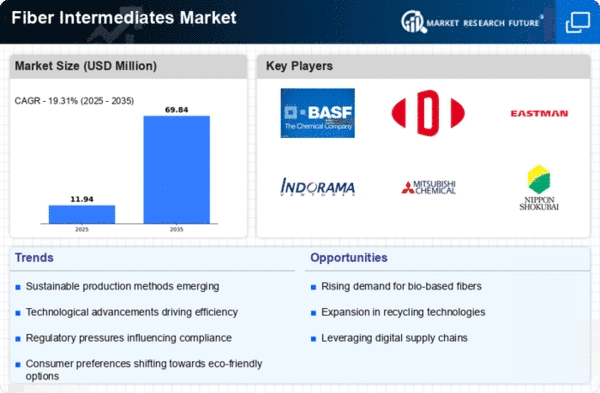

Fiber Intermediates Market Share Analysis

In the fiercely competitive Fiber Intermediates Market, companies deploy an array of market share positioning strategies to distinguish themselves and gain a competitive advantage. These strategies encompass technological innovation, product differentiation, market segmentation, sustainability initiatives, strategic collaborations, research and development (R&D) investments, cost leadership, global expansion, customer-centric practices, regulatory compliance, and brand positioning.

Technological Innovation:

Advanced Manufacturing Processes: Embracing technological advancements in fiber intermediate production enhances efficiency and product quality. Continuous research and development efforts lead to the introduction of intermediates with improved characteristics, addressing evolving industry standards and requirements. Product Differentiation:

Specialized Fiber Intermediates: Companies focus on developing specialized fiber intermediates catering to diverse applications, such as textiles, carpets, or industrial fibers. Offering intermediates tailored for specific industries or unique fiber characteristics differentiates products in a market characterized by varied fiber needs. Market Segmentation:

Tailored Solutions for Different Fibers: Recognizing diverse needs in the fiber sector, companies tailor their products for specific fiber types, such as polyester, nylon, or acrylic. Customized formulations address the unique requirements of each segment and foster brand loyalty. Sustainability Initiatives:

Environmentally Friendly Production: Growing environmental awareness drives companies to adopt sustainable practices in the production of fiber intermediates. Utilizing eco-friendly sourcing, reducing waste, and ensuring responsible manufacturing contribute to a positive brand image and market positioning. Strategic Collaborations:

Partnerships with Downstream Users: Forming strategic partnerships with downstream users, such as textile manufacturers or carpet producers, allows fiber intermediate suppliers to understand specific application needs. Co-developing tailored solutions enhances compatibility and effectiveness. Research and Development Investments:

Innovative Fiber Technologies: Companies that invest significantly in research and development gain a competitive edge by introducing innovative fiber technologies. Continuous innovation enables the development of fiber intermediates with improved strength, durability, and adaptability to different manufacturing processes. Cost Leadership:

Economies of Scale: Achieving economies of scale through efficient production processes allows companies to offer cost-competitive fiber intermediates without compromising quality. Cost-effective solutions are essential, especially for intermediates used in large-scale fiber manufacturing applications. Global Expansion:

Entering Emerging Markets: Identifying and entering emerging markets provides opportunities for growth and expansion. Adapting fiber intermediates to meet the unique demands of these markets ensures relevance and competitiveness in regions experiencing increased industrialization. Customer-Centric Practices:

Technical Support Services: Offering technical support services, including on-site assistance, training programs, and collaborative problem-solving, strengthens the relationship between companies and manufacturers. Providing resources for proper fiber intermediate application and usage builds trust and customer loyalty. Adherence to Quality Standards:

Stringent Quality Control: Adhering to strict quality control measures and obtaining relevant certifications assures manufacturers of the reliability and performance of fiber intermediates. Compliance with industry standards and regulations builds trust among customers and positions a company as a reliable and responsible supplier. Brand Positioning and Marketing:

Effective Branding: Building a strong brand presence and identity is crucial for standing out in the fiber intermediates market. Effective marketing strategies, including targeted advertising, participation in industry events, and online visibility, contribute to increased visibility and brand recognition. Focus on Fiber Applications:

Addressing End-Use Requirements: Recognizing the importance of fiber applications, companies focus on developing intermediates that address specific end-use requirements, such as flame resistance, color fastness, or moisture management. Meeting these application-specific needs enhances the value proposition of fiber intermediates.

Leave a Comment