Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the duloxetine atorvastatin-intermediates market. As healthcare spending rises, patients gain better access to medications and treatments, including those that involve duloxetine and atorvastatin. This trend is indicative of a broader willingness to invest in health, which may lead to higher prescription rates for these medications. The US healthcare expenditure is projected to reach approximately $4 trillion by 2025, reflecting a growing commitment to improving health outcomes. This increase in spending is likely to create a favorable environment for the duloxetine atorvastatin-intermediates market, as more patients seek effective treatment options.

Growing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare in the US is a notable driver for the duloxetine atorvastatin-intermediates market. As healthcare systems shift towards preventive measures, the demand for medications that can preemptively address chronic conditions rises. Duloxetine and atorvastatin, when used together, can potentially mitigate the risks associated with chronic diseases, thereby aligning with the preventive healthcare model. This shift is likely to encourage healthcare providers to prescribe these medications more frequently, contributing to market expansion. The preventive healthcare market is expected to grow by approximately 10% annually, which may positively influence the duloxetine atorvastatin-intermediates market as part of broader healthcare strategies.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research and development are significantly impacting the duloxetine atorvastatin-intermediates market. The ongoing exploration of new formulations and delivery methods enhances the effectiveness and patient compliance of these medications. Research institutions and pharmaceutical companies are investing heavily in developing novel intermediates that can improve the bioavailability and therapeutic outcomes of duloxetine and atorvastatin. This trend is expected to drive market growth, as new products enter the market and existing ones are reformulated to meet evolving patient needs. The US pharmaceutical sector is anticipated to allocate over $80 billion annually towards R&D, which could lead to breakthroughs that further stimulate the duloxetine atorvastatin-intermediates market.

Increasing Prevalence of Chronic Conditions

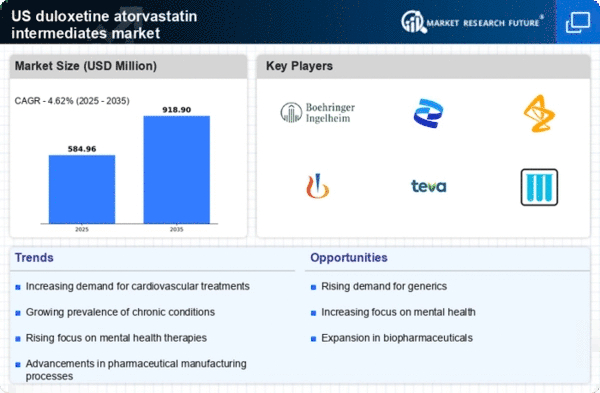

The rising incidence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders in the US is a primary driver for the duloxetine atorvastatin-intermediates market. As these conditions become more prevalent, the demand for effective treatment options increases. Duloxetine, known for its efficacy in managing pain and depression, combined with atorvastatin, which is used to lower cholesterol, creates a compelling therapeutic option. This synergy is likely to enhance the market's growth, as healthcare providers seek comprehensive solutions for patients with multiple chronic conditions. The market for duloxetine atorvastatin-intermediates is projected to grow at a CAGR of approximately 6% over the next five years, reflecting the increasing need for integrated treatment approaches.

Regulatory Support for Combination Therapies

Regulatory bodies in the US are increasingly supportive of combination therapies, which is beneficial for the duloxetine atorvastatin-intermediates market. The approval of combination drugs can streamline the treatment process for patients, making it easier for healthcare providers to prescribe effective therapies. This regulatory environment encourages pharmaceutical companies to develop and market new combinations of duloxetine and atorvastatin, thereby expanding the available options for patients. The FDA has expedited the review process for certain combination therapies, which could lead to a surge in new product launches in the coming years. This supportive regulatory framework is likely to enhance the growth prospects of the duloxetine atorvastatin-intermediates market.