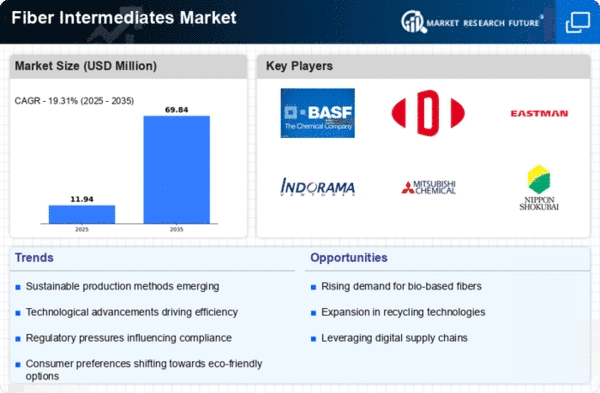

Top Industry Leaders in the Fiber Intermediates Market

The fiber intermediates market, a crucial cog in the production of synthetic fibers, textiles, and plastics, has become a battleground for global giants and niche players alike. Understanding the competitive landscape of this dynamic market is vital for anyone navigating its complexities.

The fiber intermediates market, a crucial cog in the production of synthetic fibers, textiles, and plastics, has become a battleground for global giants and niche players alike. Understanding the competitive landscape of this dynamic market is vital for anyone navigating its complexities.

Market Share Contenders and Strategies:

Integrated giants: BASF SE, DowDuPont, Reliance Industries Limited dominate with vertically integrated operations, economies of scale, and diverse product portfolios. Their strategies center around innovation, cost optimization, and geographic expansion. BASF's recent acquisition of Solvay's PA 6.6 assets exemplifies this approach.

Regional powerhouses: Companies like Formosa Plastics and Hengyi Petrochemical hold sway in specific regions through strong local supply chains and cost competitiveness. Their focus lies in catering to regional demand and leveraging government policies. Hengyi's expansion plans in China highlight this strategy.

Specialty players: Invista, Asahi Kasei, and Lotte Chemical excel in specific fiber intermediate segments like nylon and spandex. They differentiate themselves through high-performance products, technical expertise, and brand recognition. Invista's recent launch of its "Coolmax EcoDry" fabric reflects this specialization.

Emerging players: New entrants like Zhejiang Huahong Group and Jiangsu Hengshun Chemical are challenging established players with aggressive pricing and capacity expansion. Their focus is on gaining market share through cost-efficiency and targeted market penetration. Zhejiang Huahong's rapid capacity increase for PET illustrates this strategy.

Factors Shaping Market Share:

Feedstock prices: Crude oil, a key raw material, dictates production costs and profitability. Market leaders mitigate volatility through diversification and long-term supply contracts.

Technological advancements: New processes and catalysts optimize production, improve energy efficiency, and create sustainable alternatives. BASF's investment in bio-based PTA production showcases this trend.

Regional demand: Asia-Pacific is the largest and fastest-growing market, driven by textile and automotive industries. Players strategically locate production facilities and tailor offerings to regional needs.

Sustainability concerns: Environmental regulations and consumer demand for eco-friendly products push companies towards greener technologies and bio-based intermediates. Invista's development of recycled nylon fibers reflects this shift.

Trade policies: Government policies and trade agreements can significantly impact market dynamics. Tariff barriers and subsidies influence production locations and market access.

Key Players

- Reliance Industries Limited

- Aareydrugs & Pharmaceuticals Ltd (India)

- Ferromet SA

- BASF SE

- DowDuPont

- INVISTA

- Chevron Phillips Chemical Company

- Daicel Corporation

Recent Developments:

-

August: Formosa Plastics expands its PET capacity in Vietnam, targeting Southeast Asian markets. -

September: Hengyi Petrochemical starts up its new PTA plant in China, further consolidating its regional dominance. -

October: Asahi Kasei unveils a novel catalyst for PTA production, aiming to reduce energy consumption and carbon footprint. -

November: Zhejiang Huahong Group secures funding for a new PET complex in China, intensifying competition in the domestic market. -

December: Lotte Chemical enters a partnership with a European company to develop bio-based nylon fibers, responding to growing sustainability concerns.