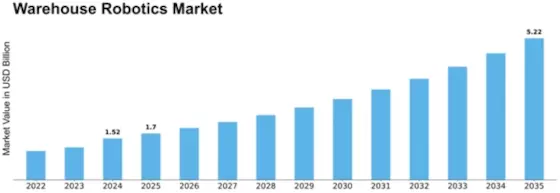

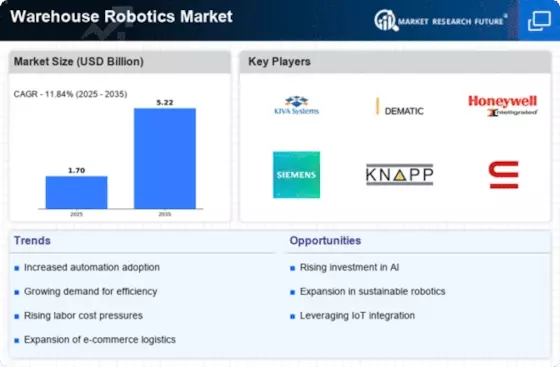

Europe Warehouse Robotics Size

Europe Warehouse Robotics Market Growth Projections and Opportunities

The Europe warehouse robotics market is undergoing significant transformations driven by various market factors that shape its landscape. One of the key factors influencing this market is the increasing demand for automation in logistics and warehousing operations. With the growing e-commerce sector and the need for efficient order fulfillment, companies are turning to warehouse robotics to streamline their processes and enhance operational efficiency.

Moreover, the labor shortage in the region is contributing to the adoption of warehouse robotics. As the traditional manual labor force becomes scarce, businesses are seeking automated solutions to mitigate the impact of workforce challenges. Warehouse robots offer a reliable and consistent alternative, ensuring the continuous flow of operations without being affected by human resource limitations.

In addition, the need for cost reduction and improved productivity is driving the adoption of warehouse robotics in Europe. Automated systems can optimize warehouse space utilization, minimize errors, and accelerate order processing, ultimately leading to cost savings and increased productivity. Businesses are recognizing the long-term benefits of investing in robotics to stay competitive in the dynamic market environment.

The advancement of technology is another significant market factor influencing the growth of warehouse robotics in Europe. Innovations in artificial intelligence, machine learning, and sensor technologies have enabled the development of more sophisticated and capable robotic systems. These advancements allow robots to handle complex tasks, adapt to dynamic environments, and collaborate seamlessly with human workers, making them an attractive solution for modern warehouses.

Furthermore, the emphasis on sustainability and environmental concerns is impacting the warehouse robotics market in Europe. Automated systems are designed to optimize energy consumption, reduce waste, and enhance overall sustainability in warehouse operations. As businesses prioritize environmentally friendly practices, the adoption of robotics aligns with their commitment to sustainable and responsible business practices.

Government initiatives and regulations also play a crucial role in shaping the Europe warehouse robotics market. Governments across the region are increasingly recognizing the importance of automation in driving economic growth and competitiveness. Supportive policies, incentives, and regulations are encouraging businesses to invest in robotics, fostering a conducive environment for the expansion of the warehouse robotics market.

The COVID-19 pandemic has accelerated the adoption of warehouse robotics in Europe. The disruptions caused by the pandemic highlighted the vulnerabilities of traditional supply chain models, prompting businesses to reassess their strategies. Warehouse robotics emerged as a resilient solution, ensuring the continuity of operations during lockdowns and restrictions. The pandemic has underscored the importance of automation in building robust and adaptable supply chains.

Leave a Comment