Advancements in Robotics Technology

Technological advancements play a crucial role in shaping the Europe Robotics Market. Innovations in robotics, such as improved sensors, artificial intelligence, and machine learning, are enhancing the capabilities of robotic systems. These advancements allow robots to perform complex tasks with greater precision and adaptability. For instance, collaborative robots, or cobots, are designed to work alongside human operators, increasing efficiency in manufacturing and assembly lines. The integration of AI into robotics is also enabling machines to learn from their environments and improve their performance over time. As these technologies continue to evolve, the Europe Robotics Market is likely to witness an influx of new applications and use cases, further driving market growth and adoption.

Increased Focus on Safety and Compliance

Safety and compliance are becoming increasingly critical in the Europe Robotics Market, particularly in sectors such as manufacturing and healthcare. As robotic systems are integrated into workplaces, ensuring the safety of human workers and compliance with regulatory standards is paramount. This focus on safety is driving the development of advanced safety features in robotic systems, such as emergency stop functions and collision detection. Moreover, regulatory bodies are establishing guidelines to govern the use of robotics, which further emphasizes the importance of compliance. Companies that prioritize safety and adhere to regulations are likely to gain a competitive edge in the market. Consequently, the emphasis on safety and compliance is expected to significantly influence the growth trajectory of the Europe Robotics Market.

Growing Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the Europe Robotics Market. Governments and private enterprises are increasingly allocating resources to develop innovative robotic solutions that address specific industry needs. This trend is evident in various sectors, including healthcare, where R&D efforts are focused on creating robotic systems for surgery, rehabilitation, and patient care. In 2025, it is estimated that R&D spending in the robotics sector in Europe will reach over 5 billion euros, reflecting a commitment to advancing technology and fostering innovation. Such investments not only enhance the capabilities of existing robotic systems but also pave the way for the introduction of groundbreaking technologies, thereby propelling the Europe Robotics Market forward.

Rising Demand for Automation in Various Sectors

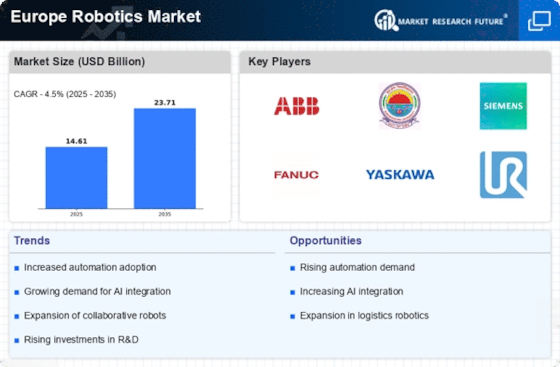

The Europe Robotics Market is experiencing a notable surge in demand for automation across multiple sectors, including manufacturing, logistics, and agriculture. This trend is driven by the need for increased efficiency and productivity, as companies seek to reduce operational costs and enhance output quality. According to recent data, the automation market in Europe is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is likely to be fueled by advancements in robotics technology, which enable more sophisticated and flexible automation solutions. As businesses increasingly adopt robotic systems, the Europe Robotics Market is poised to benefit significantly from this shift towards automation, potentially leading to a more competitive landscape in various industries.

Expansion of Robotics in Logistics and Supply Chain

The logistics and supply chain sector is witnessing a transformative shift due to the integration of robotics, which is a key driver of the Europe Robotics Market. With the rise of e-commerce and the increasing demand for faster delivery times, companies are turning to robotic solutions to streamline operations. Automated guided vehicles (AGVs) and robotic picking systems are being deployed in warehouses to enhance efficiency and reduce labor costs. Recent estimates suggest that the adoption of robotics in logistics could lead to a reduction in operational costs by up to 30%. As businesses seek to optimize their supply chains, the Europe Robotics Market is likely to see substantial growth, driven by the ongoing expansion of robotics in logistics and supply chain management.