In June 2023, Greece, via the NATO Support and Procurement Agency, made a deal with Safran SA to purchase four Patroller R-TMA UAV units. The Greek army will begin to use the Patroller UAV because it will replace the Sperwer UAVs. The UAVs are scheduled for delivery to the Greek side in the last months of the year 2024. Greece has approved the order of three ground stations as well.

In December 2022, the two sides were able to come up with terms and conditions as stated in the letter of the author dated 13 December 2022 in respect of a five-year framework agreement in the value of roughly 410 million U. S. dollars under which up to seven "Watchkeeper X" tactical unmanned aircraft systems (UAS) would be supplied to the Romanian Ministry of National Defense.

In 2021, the Defense Procurement Agency of France awarded Parrot Drone SAS the contract to supply micro-drones and ANAFI USA. These drones were military-specific, built with some of the best capabilities and high R&D for Sea, Air, and Land applications, resulting in the production of several hundred drones with software and equipment modifications and maintenance.

AgEagle Aerial Systems Inc. managed to buy out SenseFly in 2021. This buyout was very significant in pushing the core growth strategy and offering end-to-end drone solutions within the energy, construction, and agriculture domains.

In February 2023, the U.S. Air Force reported it had completed work on the creation of face identification systems within UAVs as a technology. Identify the target. Even the drone could kill itself. Moreover, the drones will be operated by special operations forces for intelligence and mission pieces of information acquisition.

In February 2023, a contract to supply 10 multicopter (VTOL) drones to the Indian Coast Guard was awarded to drone startup Sagar Defense Engineering Pvt. ICG had issued an RFP for procuring the contract under Make in India to enhance the abilities and improve marine surveillance of the ICG.

In January 2023, a contract was awarded to the Israeli-owned company Israel Aerospace Industries by the U.S. Department of Defense to design and manufacture new attack drones. These drones, referred to as Point Blank, can be swiftly transported in soldiers' backpacks and are portable.

June 2023 saw the advancement of the Northrop Grumman Corporation, which was able to deliver for the United States Navy the fourth multi-intelligence MQ-4C Triton ahead of the initial operational capability (IOC), which has been projected for this year. The delivery finalizes the set of aircraft for the initiation of the first orbit of Unmanned Patrol Squadron (VUP) 19, and another orbit is expected to be ready this summer.

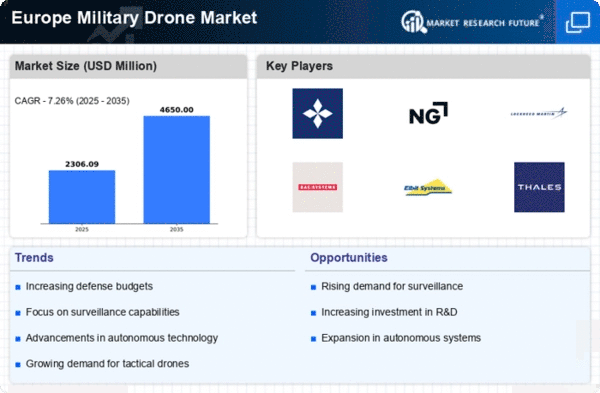

Key Companies in the Europe Military Drone Market include

- Israel Aerospace Industries Ltd

Military Drone Industry Developments

June 2023, Greece signed a four-unit contract with Safran SA for the Patroller tactical unmanned air vehicle (UAV) through the NATO Support and Procurement Agency. The Patroller UAV will replace the Greek army's existing Sperwer UAVs. The deliveries of the UAVs will begin in late 2024. Greece has also ordered three ground stations.

December 2022, Elbit Systems Ltd. signed a five-year framework deal worth approximately USD 410 million to supply up to seven "Watchkeeper X" tactical unmanned aircraft systems (UAS) to the Romanian Ministry of National Defense.