Rising Defense Budgets

In the context of the military drone market, rising defense budgets across various branches of the U.S. military are a critical driver. The U.S. government has allocated substantial funds to modernize its defense capabilities, with a notable emphasis on unmanned systems. Reports indicate that defense spending is expected to increase by approximately 5% annually over the next five years, with a significant portion directed towards drone technology. This financial commitment reflects the recognition of drones as essential assets for national security. As a result, the military drone market is likely to benefit from increased procurement and development initiatives, fostering innovation and expanding the range of available systems.

Increased Focus on Unmanned Aerial Systems

The military drone market is witnessing an increased focus on unmanned aerial systems (UAS) as military forces recognize their operational advantages. UAS provide enhanced situational awareness, reduced risk to personnel, and cost-effective solutions for various missions. The integration of UAS into military operations is becoming more prevalent, with the U.S. military actively pursuing programs to expand their capabilities. This shift is reflected in the projected growth of the military drone market, which is anticipated to reach $XX billion by 2030. The emphasis on UAS aligns with broader defense strategies aimed at leveraging technology to maintain a competitive edge.

Geopolitical Tensions and Security Concerns

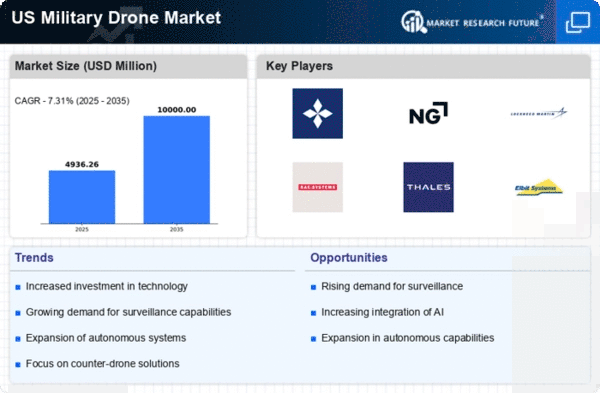

Geopolitical tensions and security concerns are pivotal factors influencing the military drone market. The ongoing conflicts and emerging threats in various regions necessitate advanced surveillance and combat capabilities. As nations seek to enhance their military readiness, the demand for drones that can provide real-time intelligence and strike capabilities is on the rise. The military drone market is expected to see a compound annual growth rate (CAGR) of around 7.31% over the next five years, driven by these security imperatives. This trend underscores the importance of drones in modern warfare, as they offer strategic advantages in both offensive and defensive operations.

Emerging Applications in Military Operations

Emerging applications of drones in military operations are reshaping the landscape of the military drone market. Drones are increasingly utilized for diverse roles, including logistics, surveillance, and combat support. The versatility of drones allows for their deployment in various scenarios, from reconnaissance missions to delivering supplies to remote locations. This adaptability is driving demand, as military forces seek to optimize their operational efficiency. The military drone market is projected to expand significantly, with estimates indicating a growth rate of approximately 8% annually. This trend highlights the evolving nature of military operations and the critical role that drones play in modern warfare.

Technological Advancements in Drone Capabilities

The military drone market is experiencing a surge in technological advancements that enhance operational capabilities. Innovations in artificial intelligence, machine learning, and sensor technology are driving the development of more sophisticated drones. These advancements allow for improved surveillance, reconnaissance, and combat capabilities. For instance, drones equipped with advanced imaging systems can provide real-time intelligence, which is crucial for mission success. The military drone market is projected to grow significantly, with estimates suggesting a valuation of approximately $XX billion by 2030. This growth is largely attributed to the increasing demand for drones that can operate in complex environments and perform a variety of missions, thereby enhancing the effectiveness of military operations.