Rising Geopolitical Tensions

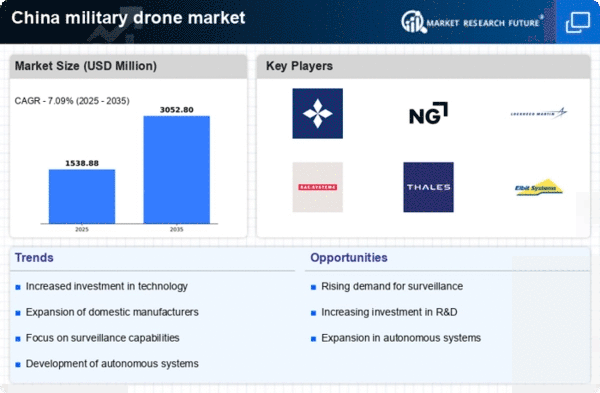

The military drone market in China is experiencing growth due to escalating geopolitical tensions in the Asia-Pacific region. As nations bolster their defense capabilities, the demand for advanced military drones is likely to increase. The Chinese government has recognized the strategic importance of unmanned aerial vehicles (UAVs) in modern warfare, leading to increased investments in drone technology. In 2025, China's defense budget is projected to reach approximately $250 billion, with a significant portion allocated to drone development. This trend suggests that the military drone market will continue to expand as China seeks to enhance its military readiness and deterrence capabilities.

Innovation in Drone Technology

The military drone market in China is significantly influenced by rapid advancements in drone technology. Innovations such as artificial intelligence (AI), machine learning, and enhanced sensor capabilities are transforming the operational effectiveness of military drones. These technological improvements enable drones to perform complex missions with greater precision and efficiency. In 2025, it is estimated that the market for military drones in China could reach $10 billion, driven by the integration of cutting-edge technologies. This trend indicates a strong potential for growth as the military drone market adapts to the evolving demands of modern warfare.

Strengthening of Domestic Defense Industry

The military drone market in China is benefiting from the strengthening of the domestic defense industry. The Chinese government has implemented policies aimed at promoting local production of military technologies, including drones. This initiative not only reduces reliance on foreign suppliers but also fosters innovation within the country. By 2025, it is anticipated that domestic manufacturers will capture a larger share of the military drone market, potentially exceeding 60%. This shift indicates a strategic move towards self-sufficiency in defense capabilities, which is likely to enhance the competitiveness of Chinese military drones on the international stage.

Growing Demand for Cost-Effective Solutions

The military drone market in China is increasingly driven by the demand for cost-effective military solutions. As defense budgets face scrutiny, there is a pressing need for affordable yet effective military technologies. Drones offer a versatile and economical alternative to traditional military assets, allowing for a wide range of applications from surveillance to combat. In 2025, the market for low-cost military drones is expected to grow by approximately 30%, reflecting the shift towards more budget-conscious defense strategies. This trend suggests that the military drone market will continue to evolve, focusing on delivering value without compromising operational capabilities.

Increased Focus on Surveillance and Reconnaissance

The military drone market in China is witnessing a heightened emphasis on surveillance and reconnaissance capabilities. As military operations become increasingly reliant on real-time intelligence, the demand for drones equipped with advanced imaging and data collection technologies is on the rise. The Chinese military has been investing heavily in drones that can provide critical situational awareness, which is essential for strategic decision-making. In 2025, it is projected that surveillance drones will account for over 40% of the military drone market, reflecting the growing importance of intelligence-gathering in contemporary military operations.