Collaborative Defense Initiatives

Collaborative defense initiatives among European nations are shaping the military drone market in France. Joint projects and partnerships aim to enhance interoperability and share technological advancements. France's involvement in initiatives such as the European Defence Fund has led to increased funding for drone development. The military drone market is likely to benefit from these collaborations, as they foster innovation and reduce costs through shared resources. In 2025, collaborative projects are expected to account for approximately 15% of the total military drone procurement budget in France, indicating a strategic shift towards cooperative defense solutions.

Regulatory Framework Enhancements

The military drone market in France is also influenced by ongoing enhancements to the regulatory framework governing drone operations. The French government is actively working to establish clear guidelines for the use of military drones, focusing on safety, privacy, and operational efficiency. These regulatory improvements are expected to facilitate the integration of drones into military operations, potentially increasing their deployment by 25% over the next few years. The military drone market is thus likely to see a positive impact from these regulatory changes, as they create a more structured environment for drone utilization in defense.

Focus on Counter-Terrorism Operations

The military drone market in France is significantly influenced by the ongoing focus on counter-terrorism operations. The French military has deployed drones extensively in various regions to monitor and neutralize terrorist threats. This operational emphasis has led to an increased budget allocation for drone technology, with estimates indicating that spending on military drones could rise by 20% over the next five years. The military drone market is thus adapting to meet the specific needs of counter-terrorism, driving innovation and the development of specialized drone systems tailored for these missions.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into military drones is transforming the operational landscape in France. AI technologies enhance the capabilities of drones, enabling autonomous flight, target recognition, and data processing. This advancement is particularly relevant in the military drone market, where the ability to process vast amounts of data in real-time is crucial. French defense contractors are increasingly investing in AI research, with projections suggesting that AI-enhanced drones could improve mission efficiency by up to 30%. As a result, the military drone market is likely to see a surge in demand for AI-integrated systems, reflecting a broader trend towards automation in defense.

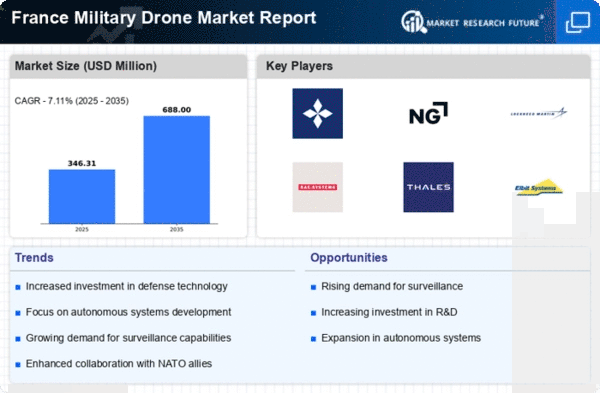

Rising Demand for Surveillance Capabilities

The military drone market in France is experiencing a notable increase in demand for advanced surveillance capabilities. This trend is driven by the need for enhanced situational awareness in military operations. The French government has recognized the importance of intelligence, surveillance, and reconnaissance (ISR) capabilities, leading to investments in drone technology. In 2025, the French military allocated approximately €1.5 billion towards the development and procurement of drones, indicating a commitment to modernizing its aerial surveillance capabilities. The military drone market is thus poised for growth as defense forces seek to leverage drones for real-time data collection and analysis.