Top Industry Leaders in the Europe Military Drone Market

Europe military drone market

In a highly competitive landscape, companies are employing various strategies to gain an edge. Established players focus on leveraging their brand reputation and longstanding relationships with military clients to secure lucrative contracts. They invest heavily in research and development to continually enhance their drone capabilities, including features like autonomous flight, advanced sensors, and stealth technology. Meanwhile, emerging companies differentiate themselves through agility and innovation, offering niche solutions or disruptive technologies that address evolving military requirements.

Strategies Adopted By Key Players Europe military drone market

- AeroVironment Inc

- BAE Systems Plc

- Elbit Systems Ltd

- General Atomics

- Lockheed Martin Corp

- Northrop Grumman Corp

- Textron Systems Corp

- Thales SA

- The Boeing Co

- Israel Aerospace Industries Ltd

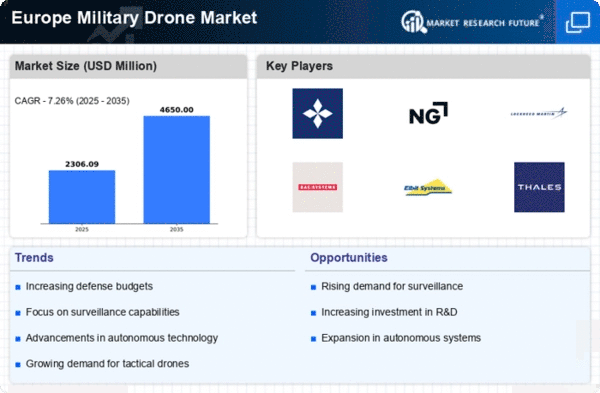

Factors for Market Share Analysis: Several factors contribute to the analysis of market share within the European military drone sector. These include technological innovation, product reliability, pricing competitiveness, regulatory compliance, and customer satisfaction. Companies that excel in these areas are more likely to capture larger market shares and sustain growth over time. Additionally, strategic partnerships, mergers, and acquisitions can also impact market dynamics, influencing the relative positions of key players within the industry.

New and Emerging Companies: The European military drone market is witnessing the emergence of several new and innovative companies seeking to carve out their niche. Startups and SMEs are leveraging advancements in artificial intelligence, miniaturization, and renewable energy to develop next-generation drone platforms with enhanced capabilities and cost-effectiveness. Companies like Parrot Drones and Teledyne FLIR are gaining attention with their focus on commercial-off-the-shelf (COTS) solutions that offer versatility and rapid deployment options for military applications.

Industry News: Recent developments in the European military drone market underscore its dynamic nature and the intense competition among players. News of major contract awards, technological breakthroughs, and regulatory updates frequently make headlines, shaping market perceptions and influencing investor sentiment. For instance, announcements of successful drone trials, collaborations between defense contractors and technology startups, and the introduction of new regulatory frameworks for unmanned aerial systems (UAS) all contribute to the evolving competitive landscape.

Current Company Investment Trends: Investment trends in the European military drone market reflect a growing appetite for innovation and strategic partnerships. Companies are increasingly allocating resources towards R&D initiatives aimed at enhancing drone performance, reliability, and mission adaptability. Moreover, strategic investments in complementary technologies such as artificial intelligence, data analytics, and cybersecurity are becoming more prevalent as companies seek to offer comprehensive solutions that address evolving defense challenges. Additionally, mergers and acquisitions are on the rise as larger players look to consolidate their market positions and expand their product portfolios through strategic acquisitions of niche technology firms.

Overall Competitive Scenario: In summary, the European military drone market presents a dynamic and competitive landscape characterized by a mix of established players, emerging companies, and disruptive innovators. Key players like Airbus, Thales, and Leonardo maintain their dominance through a combination of technological expertise, extensive industry experience, and strategic partnerships. However, they face increasing competition from agile newcomers and startups that leverage innovation and niche specialization to challenge traditional market dynamics. As the demand for military drones continues to grow and technological advancements accelerate, companies must remain vigilant and adaptable to seize opportunities and navigate the evolving competitive landscape effectively.

Recent Development:

June 2023, Greece finalized a contract with Safran SA, facilitated by the NATO Support and Procurement Agency, for the procurement of four units of the Patroller tactical unmanned air vehicle (UAV). This acquisition will see the replacement of Greece's current Sperwer UAV fleet. Deliveries of the Patroller UAVs are scheduled to commence in late 2024, accompanied by an order for three ground stations.

December 2022, Elbit Systems Ltd. secured a significant five-year framework agreement valued at around USD 410 million to supply up to seven "Watchkeeper X" tactical unmanned aircraft systems (UAS) to the Romanian Ministry of National Defense.