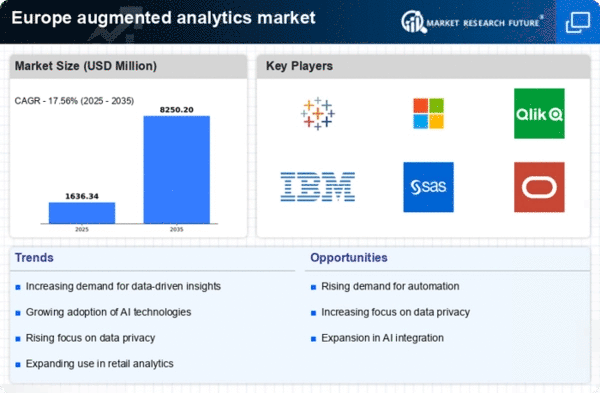

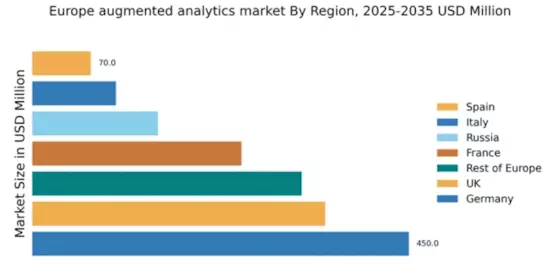

Germany : Strong Market Growth and Innovation

Germany holds a commanding market share of 36.5% in the European augmented analytics sector, valued at $450.0 million. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and a strong emphasis on data-driven decision-making. Government policies promoting innovation and technology adoption further bolster demand. The country's advanced infrastructure supports high-speed internet and cloud services, facilitating widespread analytics adoption.

UK : Innovation Meets Regulatory Challenges

The UK represents 28.0% of the European market, valued at $350.0 million. Growth is driven by a surge in demand for data analytics across sectors like finance and healthcare. The UK government has initiated several programs to support tech startups, enhancing the analytics ecosystem. However, regulatory challenges, particularly around data privacy, impact consumption patterns, necessitating compliance with GDPR and other regulations.

France : Cultural Shift Towards Data-Driven Decisions

France accounts for 20.0% of the European market, valued at $250.0 million. The growth is fueled by a cultural shift towards data-driven decision-making in businesses, supported by government initiatives like the Digital France 2025 strategy. Demand is particularly strong in retail and manufacturing sectors. The French government is also investing in digital infrastructure, enhancing connectivity and analytics capabilities.

Russia : Potential Amidst Economic Challenges

Russia holds a 12.0% market share in Europe, valued at $150.0 million. The market is driven by increasing investments in technology and analytics, particularly in the energy and telecommunications sectors. Government initiatives aimed at digital transformation are fostering growth, despite economic sanctions. The competitive landscape includes local players and international firms, with Moscow and St. Petersburg as key markets.

Italy : Balancing Tradition and Innovation

Italy represents 8.0% of the European market, valued at $100.0 million. Growth is driven by a blend of traditional industries embracing analytics, particularly in fashion and automotive sectors. Government support for digital innovation is crucial, with initiatives aimed at enhancing technological capabilities. The competitive landscape features both local and international players, with Milan as a central hub for analytics adoption.

Spain : Emerging Trends in Data Utilization

Spain accounts for 5.6% of the European market, valued at $70.0 million. The market is characterized by increasing demand for analytics in tourism and retail sectors. Government initiatives promoting digitalization are driving growth, alongside a rising number of startups in the analytics space. Key cities like Barcelona and Madrid are pivotal in shaping the competitive landscape, with both local and international players present.

Rest of Europe : Varied Growth Across Sub-Regions

The Rest of Europe holds a market share of 25.8%, valued at $321.92 million. This diverse region showcases varying growth rates, driven by local industries and government initiatives. Countries like the Netherlands and Sweden are leading in analytics adoption, supported by strong tech ecosystems. The competitive landscape includes both established players and emerging startups, catering to sector-specific needs across industries.