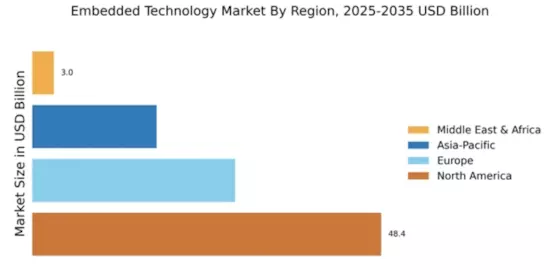

North America : Innovation and Market Leadership

North America continues to lead the Embedded Technology Market, holding a significant share of 48.39% in 2025. The region's growth is driven by rapid advancements in IoT, AI, and automotive technologies, alongside strong investments in R&D. Regulatory support for tech innovation and a robust infrastructure further catalyze demand, making it a hub for embedded solutions. The competitive landscape is characterized by major players such as Intel Corporation, Texas Instruments, and Qualcomm, which are at the forefront of technological advancements. The U.S. and Canada are the leading countries, with a strong focus on developing smart devices and systems. This region's emphasis on innovation and quality positions it as a critical player in the global market.

Europe : Regulatory Support and Growth

Europe's Embedded Technology Market is projected to reach a size of 28.14% by 2025, driven by stringent regulations promoting energy efficiency and sustainability. The European Union's Green Deal and Digital Strategy are pivotal in shaping market dynamics, encouraging the adoption of advanced embedded systems across various sectors, including automotive and healthcare. Leading countries like Germany, France, and the Netherlands are home to key players such as NXP Semiconductors and STMicroelectronics. The competitive landscape is marked by a strong emphasis on innovation and collaboration among tech firms and research institutions, fostering a vibrant ecosystem for embedded technologies. This synergy is crucial for maintaining Europe's competitive edge in the global market.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region is witnessing rapid growth in the Embedded Technology Market, with a market share of 17.25% anticipated by 2025. This growth is fueled by increasing demand for consumer electronics, smart appliances, and automotive applications. Countries are investing heavily in digital transformation initiatives, supported by government policies that promote technology adoption and innovation. China, Japan, and South Korea are the leading countries in this region, hosting major players like Renesas Electronics and Infineon Technologies. The competitive landscape is evolving, with a focus on enhancing product capabilities and reducing costs. This region's dynamic market environment is essential for driving advancements in embedded technologies, positioning it as a key player in the global arena.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region, while currently holding a smaller market share of 3.0%, presents significant growth opportunities in the Embedded Technology Market. The region is experiencing a surge in demand for smart technologies, driven by urbanization and government initiatives aimed at digital transformation. Investments in infrastructure and technology are expected to catalyze market growth in the coming years. Countries like South Africa and the UAE are leading the charge, with a growing presence of tech companies and startups focusing on embedded solutions. The competitive landscape is gradually evolving, with local and international players collaborating to enhance technological capabilities. This region's potential for growth makes it an attractive market for embedded technology investments.