Increased Investment in R&D

The Autonomous Vehicles Market is witnessing a surge in investment directed towards research and development. Major automotive manufacturers and tech companies are allocating substantial resources to innovate and enhance autonomous driving technologies. In 2025, it is estimated that investments in R&D for autonomous vehicles could reach approximately 100 billion dollars, reflecting a commitment to advancing safety, efficiency, and user experience. This influx of capital is likely to accelerate the development of advanced sensors, artificial intelligence, and machine learning algorithms, which are crucial for the functionality of autonomous vehicles. As these technologies mature, they may lead to more reliable and safer autonomous systems, thereby fostering greater consumer trust and acceptance in the Autonomous Vehicles Industry.

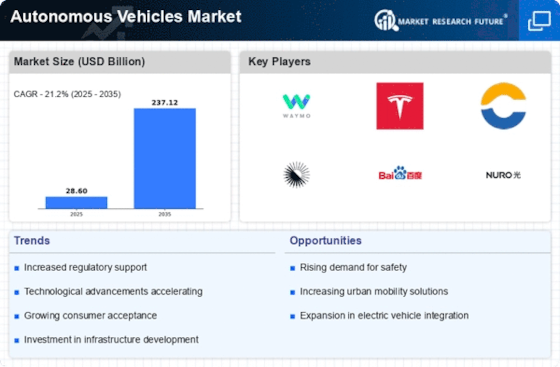

Regulatory Support and Frameworks

The Autonomous Vehicle Market is benefiting from the establishment of supportive regulatory frameworks. Governments are increasingly recognizing the potential of autonomous vehicles to enhance road safety and reduce traffic congestion. By 2025, many regions are expected to implement regulations that facilitate the testing and deployment of autonomous vehicles on public roads. This regulatory support may include guidelines for safety standards, liability issues, and data privacy concerns. As a result, the Autonomous Vehicle Industry is likely to experience accelerated growth, as manufacturers gain clarity on compliance requirements. This proactive approach by regulators could foster innovation and encourage investment in autonomous vehicle technologies.

Growing Demand for Mobility Solutions

The Autonomous Vehicles Market is experiencing a notable increase in demand for innovative mobility solutions. Urbanization and population growth are driving the need for efficient transportation alternatives. By 2025, it is projected that the demand for shared autonomous vehicles could rise significantly, with estimates suggesting that shared mobility services may account for over 30% of the total vehicle market. This shift towards shared mobility is likely to reduce congestion and lower emissions, aligning with sustainability goals. Consequently, the Autonomous Vehicles Industry is adapting to meet these evolving consumer preferences, which may lead to the development of new business models and partnerships among automotive manufacturers, technology firms, and service providers.

Advancements in AI and Machine Learning

The Autonomous Vehicles Market is significantly influenced by advancements in artificial intelligence and machine learning technologies. These innovations are essential for the development of autonomous driving systems, enabling vehicles to interpret complex environments and make real-time decisions. In 2025, it is anticipated that the integration of AI in autonomous vehicles will enhance their ability to navigate safely and efficiently. The market for AI in automotive applications is projected to grow at a compound annual growth rate of over 40%, indicating a robust demand for intelligent systems. As these technologies evolve, they may lead to improved safety features and user experiences, thereby driving further growth in the Autonomous Vehicle Industry.

Environmental Sustainability Initiatives

The Autonomous Vehicles Industry is increasingly aligned with environmental sustainability initiatives. As concerns about climate change and air quality intensify, there is a growing emphasis on reducing carbon emissions from transportation. Autonomous vehicles, particularly electric ones, are seen as a viable solution to address these challenges. By 2025, it is projected that the adoption of electric autonomous vehicles could contribute to a significant reduction in greenhouse gas emissions, potentially decreasing transportation-related emissions by up to 20%. This alignment with sustainability goals is likely to attract investment and consumer interest, further propelling the growth of the Autonomous Vehicles Market.