Emergence of Edge Computing

The rise of edge computing is poised to transform The Global Embedded Software Industry. As organizations increasingly seek to process data closer to the source, the demand for embedded software that can operate efficiently at the edge is likely to grow. This shift is driven by the need for real-time data processing and reduced latency in applications such as IoT and smart cities. Market analysts suggest that the edge computing market could reach 15 billion USD by 2026, which may create new opportunities for embedded software developers. The ability to deploy software solutions that can function autonomously in distributed environments is becoming crucial, thereby influencing the trajectory of The Global Embedded Software Industry.

Growth of Industrial Automation

The trend towards industrial automation is significantly impacting The Global Embedded Software Industry. As industries seek to enhance productivity and reduce operational costs, the adoption of embedded systems in manufacturing processes is becoming more prevalent. Reports indicate that the industrial automation market is expected to exceed 200 billion USD by 2025, which could lead to a corresponding increase in demand for embedded software solutions. These systems are essential for managing complex machinery and ensuring seamless communication between devices. The push for smart factories and Industry 4.0 initiatives is likely to further drive the need for advanced embedded software, thereby shaping the future landscape of The Global Embedded Software Industry.

Rising Demand for Smart Devices

The increasing proliferation of smart devices across various sectors appears to be a primary driver for The Global Embedded Software Industry. As consumers and businesses alike seek enhanced functionality and connectivity, the demand for embedded software solutions is likely to surge. According to recent estimates, the market for smart devices is projected to reach over 1.5 billion units by 2026, which could significantly boost the embedded software sector. This trend is particularly evident in consumer electronics, automotive, and healthcare industries, where embedded systems are integral to device performance. The need for sophisticated software that can manage complex tasks in real-time is becoming more pronounced, thereby propelling the growth of The Global Embedded Software Industry.

Increased Focus on Cybersecurity

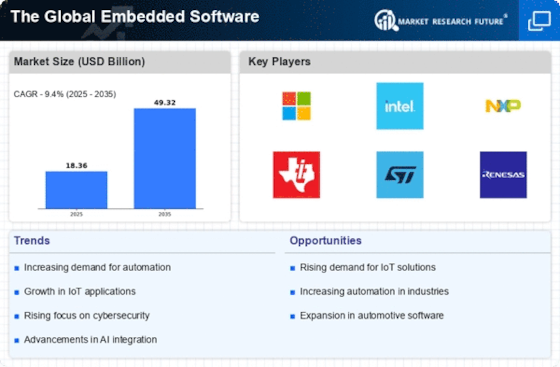

As cyber threats continue to evolve, the emphasis on cybersecurity within The Global Embedded Software Industry is becoming more pronounced. Organizations are increasingly recognizing the importance of securing embedded systems against potential vulnerabilities. The Global Embedded Software Market is projected to grow significantly, with estimates suggesting it could surpass 300 billion USD by 2024. This growth is likely to drive demand for embedded software solutions that incorporate robust security features. Manufacturers are compelled to integrate security measures into their products from the design phase, which may lead to a surge in the development of secure embedded software. Consequently, this focus on cybersecurity is expected to play a pivotal role in shaping the future of The Global Embedded Software Industry.

Advancements in Automotive Technology

The automotive sector is undergoing a transformative phase, with advancements in technology driving The Global Embedded Software Industry. The integration of advanced driver-assistance systems (ADAS) and autonomous driving features necessitates sophisticated embedded software solutions. It is estimated that the automotive embedded software market could grow at a compound annual growth rate (CAGR) of over 10% through the next few years. This growth is fueled by the increasing focus on safety, efficiency, and user experience in vehicles. As manufacturers strive to meet regulatory standards and consumer expectations, the demand for innovative embedded software solutions is likely to escalate, thereby influencing the overall dynamics of The Global Embedded Software Industry.