Growth in Industrial Automation

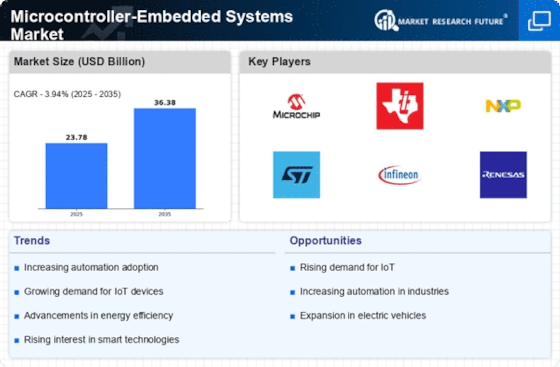

The Microcontroller-Embedded Systems Market is poised for growth due to the rising trend of industrial automation. As industries seek to enhance productivity and efficiency, the adoption of microcontroller-based systems is becoming increasingly prevalent. These systems facilitate real-time monitoring, control, and data acquisition, which are critical for modern manufacturing processes. In 2025, the industrial automation sector is expected to contribute significantly to the microcontroller market, with growth projections indicating an increase of approximately 9%. This trend underscores the importance of microcontrollers in streamlining operations and reducing operational costs, thereby reinforcing their role in the Microcontroller-Embedded Systems Market.

Emergence of Smart Infrastructure

The Microcontroller-Embedded Systems Market is being propelled by the emergence of smart infrastructure initiatives. Governments and organizations are investing in smart city projects that leverage microcontroller technology to improve urban living conditions. These initiatives encompass smart lighting, traffic management systems, and waste management solutions, all of which rely on microcontroller-embedded systems for efficient operation. By 2025, the smart infrastructure segment is projected to experience a growth rate of around 7%, reflecting the increasing reliance on technology to enhance urban environments. This trend indicates a promising future for the Microcontroller-Embedded Systems Market as it aligns with global sustainability goals and urban development strategies.

Expansion of Automotive Applications

The Microcontroller-Embedded Systems Market is significantly influenced by the expansion of automotive applications. With the automotive sector increasingly adopting advanced technologies, microcontrollers play a pivotal role in enhancing vehicle performance, safety, and connectivity. The integration of microcontrollers in electric vehicles and autonomous driving systems is particularly noteworthy. In 2025, it is anticipated that the automotive segment will represent a considerable portion of the microcontroller market, with a projected growth rate of around 10%. This growth is indicative of the industry's shift towards smarter vehicles, where microcontroller-embedded systems are essential for managing complex functionalities, thereby driving the overall market forward.

Surge in Consumer Electronics Demand

The Microcontroller-Embedded Systems Market is experiencing a notable surge in demand driven by the increasing proliferation of consumer electronics. As devices such as smartphones, wearables, and smart home appliances become more sophisticated, the need for efficient microcontroller solutions has escalated. In 2025, the consumer electronics sector is projected to account for a substantial share of the microcontroller market, with estimates suggesting a growth rate of approximately 8% annually. This trend indicates that manufacturers are increasingly integrating advanced microcontrollers to enhance functionality and user experience. Consequently, the Microcontroller-Embedded Systems Market is likely to witness a robust expansion as companies strive to meet consumer expectations for smarter, more connected devices.

Advancements in Healthcare Technology

The Microcontroller-Embedded Systems Market is significantly impacted by advancements in healthcare technology. The integration of microcontrollers in medical devices, such as diagnostic equipment and wearable health monitors, is transforming patient care. These systems enable real-time data collection and analysis, which are crucial for effective healthcare delivery. In 2025, the healthcare sector is expected to account for a notable share of the microcontroller market, with growth estimates suggesting an increase of approximately 8%. This trend highlights the critical role of microcontroller-embedded systems in enhancing medical technology, thereby driving innovation and improving patient outcomes within the Microcontroller-Embedded Systems Market.