Increased Adoption of Electric Vehicles

The Electric Parking Brake Market is significantly influenced by the rising adoption of electric vehicles (EVs). As the automotive sector transitions towards electrification, the need for efficient and space-saving braking systems becomes paramount. Electric parking brakes are particularly well-suited for EVs, as they require less mechanical space and can be integrated seamlessly with regenerative braking systems. Market data suggests that the EV segment is expected to account for over 30% of new vehicle sales by 2030, thereby driving the demand for electric parking brakes. This shift not only supports the growth of the electric parking brake market but also aligns with the global push for sustainable transportation solutions.

Regulatory Support for Emission Reduction

The Electric Parking Brake Market is also being driven by regulatory support aimed at reducing vehicle emissions. Governments worldwide are implementing stringent regulations to promote cleaner technologies, which indirectly boosts the adoption of electric parking brakes. These systems contribute to overall vehicle efficiency, particularly in hybrid and electric vehicles, by minimizing energy loss during braking. As regulations become more rigorous, manufacturers are compelled to adopt electric parking brakes to comply with these standards. This regulatory environment is likely to foster innovation and investment in electric parking brake technologies, further enhancing their market presence.

Rising Demand for Advanced Safety Features

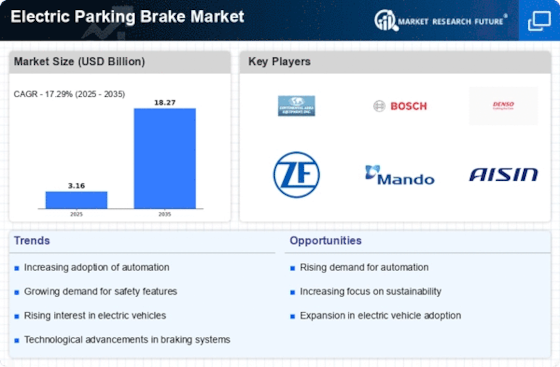

The Electric Parking Brake Market is experiencing a notable surge in demand for advanced safety features in vehicles. As consumers become increasingly aware of safety standards, manufacturers are integrating electric parking brakes to enhance vehicle safety. This technology not only provides better control during parking but also reduces the risk of accidents caused by traditional handbrakes. According to recent data, the adoption of electric parking brakes is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates a shift towards more sophisticated braking systems, which aligns with the broader movement towards enhanced vehicle safety and automation.

Technological Innovations in Automotive Design

The Electric Parking Brake Market is benefiting from ongoing technological innovations in automotive design. Manufacturers are increasingly focusing on integrating advanced technologies such as electronic control units and software algorithms to enhance the functionality of electric parking brakes. These innovations allow for features like automatic engagement and disengagement, which improve user convenience and vehicle performance. Furthermore, the integration of electric parking brakes with other vehicle systems, such as stability control and driver assistance technologies, is becoming more prevalent. This trend is expected to propel the market forward, as automakers seek to differentiate their products in a competitive landscape.

Consumer Preference for Convenience and Ease of Use

The Electric Parking Brake Market is witnessing a shift in consumer preferences towards convenience and ease of use in vehicle features. Modern consumers are increasingly favoring vehicles equipped with user-friendly technologies that simplify driving experiences. Electric parking brakes offer significant advantages over traditional systems, such as one-touch operation and automatic engagement, which appeal to a tech-savvy demographic. Market Research Future indicates that consumer interest in smart vehicle technologies is on the rise, with a substantial percentage of potential buyers expressing a preference for vehicles equipped with electric parking brakes. This trend suggests a growing market potential for electric parking brake systems as manufacturers adapt to changing consumer demands.