Top Industry Leaders in the Electric Parking Brake Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

The Electrifying Race: Analyzing the Competitive Landscape of Electric Parking Brakes

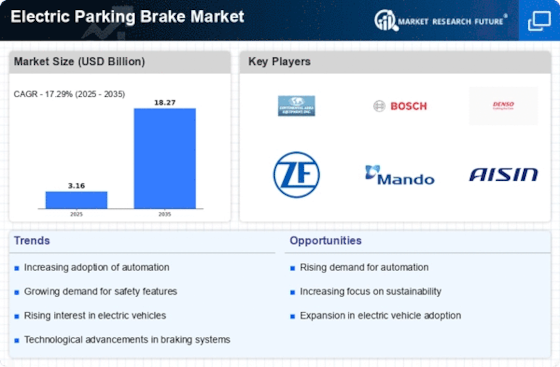

The electric parking brake (EPB) market is revving up, propelled by factors like rising automation, increasing demand for comfort features, and the burgeoning electric vehicle (EV) segment. Navigating this dynamic landscape necessitates a close look at the key players, their strategies, and the ever-evolving trends defining the competitive scenario.

Market Titans and their Maneuvers:

Tier 1 automotive suppliers like Continental AG, Bosch, and ZF Friedrichshafen AG dominate the EPB market, leveraging their established presence, technological expertise, and extensive global reach. Continental's recent lightweight and less complex EPB system for EVs demonstrates their focus on innovation and catering to specific market segments.

Tier 2 players like Aisin Seiki Co. Ltd. are forging strategic partnerships, like their collaboration with Joyson Safety Systems for the Chinese market, to capture regional growth opportunities. While smaller players like Brembo and FTE Automotive are carving a niche by offering cost-effective and niche solutions like EPBs for commercial vehicles.

Factors Revving Up Market Share Analysis:

Determining market share in the EPB arena requires a multi-pronged approach. Traditional metrics like revenue and volume paint a partial picture. Additional factors like geographical presence, product portfolio diversity (covering cable-pull and electric-hydraulic systems), and technological advancements in areas like self-parking features hold significant weight.

Trendspotting: The Road Ahead:

The EPB market is witnessing some electrifying trends:

EV Integration: The rising adoption of EVs is fostering the development of EPBs specifically designed for their unique braking needs and regenerative braking systems.

Advanced Functionality: Automakers are integrating EPBs with features like auto-hold, hill-start assist, and automatic parking, enhancing driver convenience and safety.

Connectivity and Data: The future promises EPBs embedded with sensors and connected to onboard computers, enabling real-time monitoring and predictive maintenance.

Navigating the Electric Curve:

The competitive landscape of the EPB market is characterized by intense competition, rapid technological advancements, and evolving customer demands. To stay ahead, players need to:

Prioritize R&D: Continuous innovation in areas like miniaturization, material optimization, and software integration is crucial.

Embrace Partnerships: Collaborations with automakers, technology providers, and regional players can unlock new markets and expertise.

Focus on Sustainability: Developing lightweight and energy-efficient EPBs caters to the growing eco-conscious consumer base.

In conclusion, the EPB market is experiencing an electrifying growth trajectory. Understanding the strategies of key players, analyzing market share through a comprehensive lens, and staying ahead of emerging trends are crucial for navigating this dynamic and competitive landscape. Only those who adapt and innovate can truly brake away from the pack and secure their position in the race for future market dominance.

Aisin Seiki:

- October 2023: Launched new compact and lightweight EPB for electric vehicles (EVs), aiming for mass production in 2024. (Source: Aisin Seiki press release)

Continental AG:

- December 2023: Unveiled next-generation EPB with integrated automatic parking function. (Source: Continental press release)

DURA Automotive Systems:

- September 2023: Secured major contract to supply EPB systems for a European automaker's new SUV model. (Source: DURA Automotive press release)

TBK Co. Ltd.:

- August 2023: Expanded production capacity for EPB systems at its Japanese plant. (Source: Nikkei Asian Review)

Hyundai Mobis Co. Ltd.:

- July 2023: Received an award for its innovative EPB design aimed at reducing costs and complexity. (Source: Korea Automotive Technology Institute)

Top listed global companies in the industry are:

Aisin Seiki Co. Ltd. (Japan)

Continental AG (Germany)

DURA Automotive Systems (US)

TBK Co. Ltd. (Tokyo)

Hyundai Mobis Co.Ltd. (South Korea)

Küster Holding GmbH (Germany)

Mando-Hella Electronics Corp. (South Korea)

Svenska Kullagerfabriken AB (Sweden)

ZF Friedrichshafen AG (Germany)

Wuhu Bethel Automotive Safety Systems Co. Ltd (China)

Zhejiang Wanchao Electric Appliance Co. Ltd. (China)