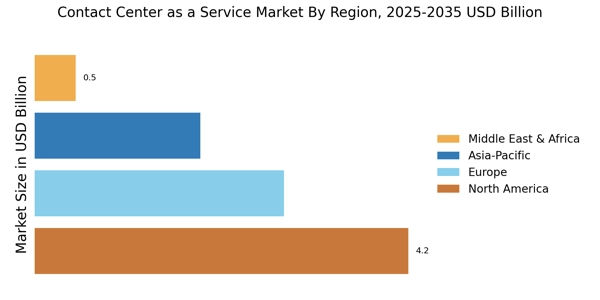

North America : Leading Innovation and Growth

North America is the largest market for Contact Center as a Service Market (CCaaS), holding approximately 45% of the global market share. The region's growth is driven by the increasing demand for cloud-based solutions, enhanced customer experience, and the adoption of AI technologies. Regulatory support for digital transformation initiatives further catalyzes this growth, making it a hub for innovation in customer service solutions. The United States is the primary player in this market, with significant contributions from companies like Five9, RingCentral, and Twilio. The competitive landscape is characterized by rapid technological advancements and a focus on customer-centric solutions. Canada also plays a vital role, contributing to the market's expansion with its growing tech ecosystem and regulatory support for digital services. North America accounted for the largest contact center market share in 2024, driven by early cloud adoption.

Europe : Emerging Market with Potential

Europe is witnessing a significant transformation in the Contact Center as a Service Market, holding around 30% of the global share. The region's growth is fueled by increasing investments in digital customer engagement and the need for compliance with data protection regulations like GDPR. The Europe Contact Center as a Service market is expanding as businesses intensify digital transformation efforts and invest in cloud‑based customer engagement platforms that comply with data privacy standards such as GDPR, driving demand for advanced CCaaS solutions across France, Germany, and the UK. The contact center Europe market is expanding due to GDPR-compliant cloud adoption across the UK, Germany, and France.

Countries are focusing on enhancing customer experience, which is driving demand for innovative CCaaS solutions. Leading countries in this region include the UK, Germany, and France, where major players like Genesys and NICE are establishing a strong presence. The competitive landscape is evolving, with a mix of established firms and emerging startups. The European market is characterized by a strong emphasis on regulatory compliance and customer data security, which shapes the offerings of CCaaS providers.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly emerging as a powerhouse in the Contact Center as a Service Market, accounting for approximately 20% of the global market share. The region's growth is driven by the increasing adoption of cloud technologies, rising consumer expectations, and a growing focus on digital transformation across various industries. The China Contact Center as a Service market is charting rapid growth owing to extensive digital infrastructure investments and surging demand for localized cloud contact center platforms across e‑commerce, telecom, and financial services sectors.

Government initiatives promoting digital infrastructure are also significant catalysts for market expansion. Key players in this region include Twilio and Cisco, with countries like China, India, and Australia leading the charge. The competitive landscape is marked by a mix of local and international players, all vying for market share. The region's diverse market demands are pushing providers to innovate and tailor their solutions to meet specific customer needs, enhancing overall service delivery.

Middle East and Africa : Emerging Market with Opportunities

The Middle East and Africa region is gradually emerging in the Contact Center as a Service Market, holding about 5% of the global share. The growth is primarily driven by the increasing focus on digital transformation initiatives and the rising demand for customer engagement solutions. Governments in the region are investing in technology infrastructure, which is expected to further boost market growth in the coming years. Countries like the UAE and South Africa are leading the way, with a growing number of local and international players entering the market. The GCC Contact Center as a Service market is gaining momentum as enterprises in the UAE, Saudi Arabia, and Qatar seek cloud‑native contact center platforms that support multilingual customer engagement and digital transformation strategies. The competitive landscape is evolving, with a focus on providing tailored solutions to meet the unique needs of businesses in the region. As the market matures, there is a significant opportunity for innovation and growth in CCaaS offerings.