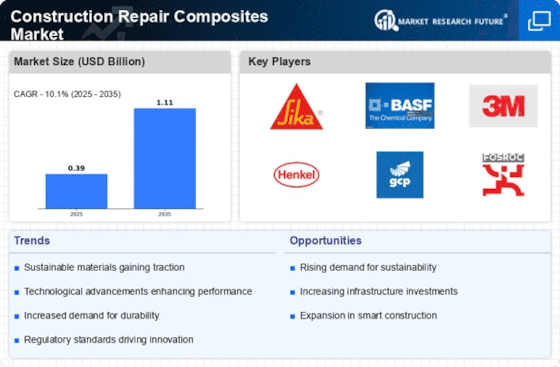

Leading market players are putting a lot of money into R&D to expand their product line, which will help the Construction Repair Composites Market, grow even more. Additionally, market participants are engaging in a range of strategic initiatives to increase their worldwide reach, with important market developments such as the introduction of new products, contracts, mergers and acquisitions, increased investments, and cooperation with other organizations. To grow and endure in an increasingly competitive and challenging market environment, Construction Repair Composites industry must provide reasonably priced goods.

One of the main business strategies employed by manufacturers is to produce locally to reduce operational expenses in the Construction Repair Composites industry to develop market sector and provide benefits to customers. In recent years, the Construction Repair Composites industry has provided some of the most important benefits to the infrastructure sector. Major players in the Construction Repair Composites Market, including Sika AG, BASF SE, Arkema SA, Owens Corning, Saint-Gobain S.A., S&P Inc., DuPont de Nemours, Inc., Ashland Holdings Inc., Henkel AG & Co. KGaA, W.R.

Grace & Co., PPG Industries, Inc., Mapei S.p.A., and others, are attempting to increase market demand by investing in research and development operations.

Swiss multinational Sika AG, with its headquarters in Baar, provides speciality chemicals to the building and automotive industries. The business creates systems and goods for bonding, sealing, dampening, strengthening, and protecting. It currently has more than 33,000 workers, subsidiaries in more than 100 countries, and a CHF 10.5 billion annual sales turnover. Kaspar Winkler lay the company's foundational stone in 1910, establishing Sika as a result. After rising out of poverty to become a prosperous businessman, Winkler began establishing subsidiaries abroad during the 1920s.

In 2023, Sika purchased MBCC, a company with operations in 60 countries, 95 production facilities, 6,200 workers, and a 2022 revenue forecast of 2,100 million CHF.

Along with its six integrated manufacturing sites, BASF has 390 more production facilities across Europe, Asia, Australia, the Americas, and Africa. It also maintains joint ventures and subsidiaries in more than 80 countries. Over 190 nations are BASF's customers, and the business provides its products to numerous industries. The corporation, despite its size and reach, combined with a number of other German chemical firms to become the chemicals conglomerate IG Farben. The economic development of Nazi Germany was significantly influenced by IG Farben.

In 2019, the sale of BASF's ultra filtration membrane company, Inge GmbH, was negotiated with DuPont Safety & Construction, a DuPont Co. subsidiary business unit. Executives from BASF claim that Inge GmbH and its goods work better with DuPont and their corporate strategy.