North America : Construction Innovation Leader

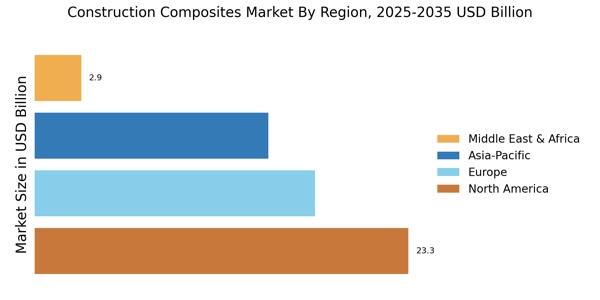

North America is the largest market for construction composites, holding approximately 40% of the global share. The region's growth is driven by increasing infrastructure investments, a shift towards sustainable building materials, and stringent regulations promoting energy efficiency. The demand for lightweight and durable materials is also on the rise, further propelling market expansion. The United States and Canada are the leading countries in this sector, with major players like BASF SE, DuPont de Nemours Inc, and Owens Corning dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships, as companies strive to meet the evolving needs of the construction industry. The presence of advanced manufacturing facilities enhances the region's capability to produce high-quality composites.

Europe : Sustainable Building Focus

Europe is the second-largest construction composite market, accounting for around 30% of the global construction composite market share. The composites in the European construction market is fueled by stringent environmental regulations and a strong emphasis on sustainable construction practices. Initiatives aimed at reducing carbon footprints and enhancing energy efficiency are key drivers of demand for advanced composite materials. Developed and emerging economies alike are contributing to growth in the composites in construction market, supported by urbanization and increased investment in modern building technologies.

Leading countries in Europe include Germany, France, and the UK, where companies like Sika AG and Solvay SA are prominent. The competitive landscape is marked by innovation and collaboration among industry players, supported by government initiatives that promote research and development in composite technologies. This collaborative environment fosters advancements that align with the region's sustainability goals.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the construction composites market, holding approximately 25% of the global share. The region's expansion is driven by urbanization, increasing infrastructure projects, and a growing demand for lightweight materials. Countries like China and India are leading this growth in the construction repair composites market, supported by government initiatives aimed at enhancing construction efficiency and sustainability.

China is the largest construction composite market in the region, with significant investments in infrastructure and construction. Key players such as Mitsubishi Chemical Corporation and Teijin Limited are actively involved in this construction composite market, focusing on innovative solutions to meet the rising demand. The competitive landscape is evolving, with local manufacturers increasingly entering the construction composite market, enhancing competition and driving innovation.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is emerging as a significant player in the construction composites market, accounting for about 5% of the global share. The growth is primarily driven by increasing investments in infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries. The region's focus on diversifying economies and enhancing construction capabilities is fostering demand for advanced composite materials in construction repair composites market.

Leading countries include the UAE and South Africa, where major construction projects are underway. The competitive landscape features both international and local players, with companies exploring innovative composite solutions to meet the unique challenges of the region in construction repair composites market. The presence of key players is expected to grow as the market matures and demand increases.