Market Share

Construction Repair Composites Market Share Analysis

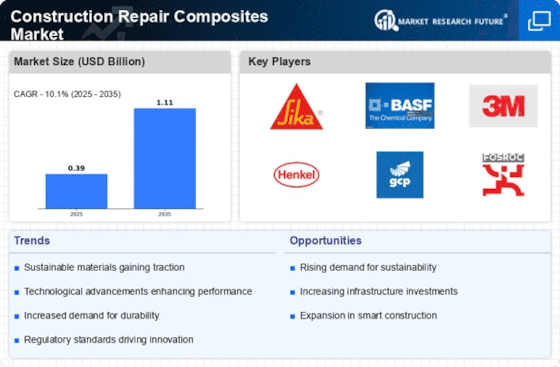

The Construction Repair Composites Market is undergoing strategic transformations as companies strive to establish a robust presence in the construction and infrastructure repair sector. To gain a competitive edge, businesses are deploying various market positioning strategies that encompass product innovation, diversification, and sustainability. Here are key strategies employed in the market share positioning of Construction Repair Composites: Innovative Composite Formulations: Leading companies in the Construction Repair Composites Market prioritize innovation in composite formulations. This involves the development of advanced repair composites with enhanced bonding strength, durability, and resistance to environmental factors. Continuous research and development efforts contribute to the introduction of repair composites that offer superior performance and versatility, positioning manufacturers as leaders in the field. Diversification of Applications: To broaden market reach, companies focus on diversifying the applications of repair composites. This includes their use in repairing and strengthening structures such as bridges, buildings, pipelines, and industrial facilities. Diversification allows companies to cater to the evolving needs of various construction and infrastructure projects, positioning repair composites as indispensable components. Sustainable and Eco-Friendly Solutions: With an increasing focus on sustainability, companies in the Construction Repair Composites Market are adopting eco-friendly practices. This includes the development of repair composites with reduced environmental impact, use of recycled materials, and adherence to green building standards. Positioning repair composites as sustainable aligns with global environmental goals and attracts environmentally conscious clients and construction projects. Customization for Specific Applications: Customization is a key strategy in the market, with companies tailoring repair composites for specific applications and requirements. This involves offering a range of formulations suitable for diverse structural materials, environmental conditions, and repair scenarios. Providing customized solutions enhances the versatility of repair composites and allows manufacturers to address a wide range of customer needs. Strategic Alliances with Construction Companies: Collaborative efforts with construction companies, contractors, and engineering firms form a strategic approach. Partnerships enable companies to work closely with industry stakeholders, providing tailored solutions, and ensuring compatibility with specific construction projects. Joint ventures and collaborations enhance the overall value proposition, making a company more attractive to construction professionals seeking reliable and innovative repair composite solutions. Global Market Expansion: Companies aiming for increased market share strategically expand their global presence. This involves entering new markets, establishing partnerships with distributors, and adapting repair composites to meet diverse international standards. A global footprint not only widens the customer base but also positions a company as a reliable supplier capable of meeting the diverse needs of an international clientele. Investment in Research and Development: A commitment to research and development is crucial for staying competitive in the Construction Repair Composites Market. Companies invest in R&D to explore new formulations, improve application techniques, and stay ahead of industry trends. Innovations stemming from R&D efforts contribute to positioning manufacturers as leaders in the development of cutting-edge repair composite solutions for the construction and infrastructure repair sector. Training and Certification Programs: Providing education and training programs to construction professionals is a strategic approach. This includes training on the proper use, application techniques, and best practices for repair composites. Educated professionals are more likely to choose and effectively use repair composites, contributing to customer satisfaction and loyalty.

Leave a Comment