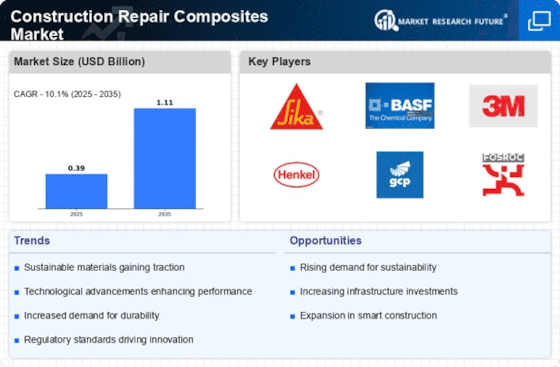

Top Industry Leaders in the Construction Repair Composites Market

The construction repair composites market is more than just a paint-and-patch job. It's an exciting arena where cutting-edge materials and innovative techniques converge to breathe new life into aging infrastructure, boost its resilience, and extend its lifespan. Let's delve into the strategies employed by key players, the factors influencing market share, and the recent developments propelling this dynamic domain.

Strategies Shaping the Landscape:

-

Material Innovation: Leading players like Sika, BASF, and Owens Corning are pushing the boundaries of traditional repair composites, developing lightweight, high-strength carbon fiber and epoxy resin systems for structural reinforcement. Think innovative bonding agents, self-healing polymers, and fire-resistant composites tailored to specific repair needs.

-

Sustainability Focus: The green wave is washing over the market, with companies like Saint-Gobain and Henkel leading the charge with bio-based composites, recycled materials, and low-VOC formulations. Minimizing environmental impact and promoting circularity are becoming key differentiators.

-

Digital and Robotic Integration: Embracing technological advancements, companies like Hilti and Bosch are integrating 3D scanning, digital twins, and robotic application systems to improve accuracy, efficiency, and worker safety during repair projects.

-

Focus on Niche Markets: Specialized solutions are gaining traction. Companies like CTS Composite Repair Services cater to specific sectors like bridges, wind turbine blades, and offshore platforms, offering tailored repair solutions and expertise.

-

Knowledge Sharing and Training: Recognizing the crucial role of skilled professionals, industry leaders like the American Composites Manufacturers Association (ACMA) organize training programs and certification courses to upskill the workforce and promote best practices.

Factors Influencing Market Share:

-

Performance and Durability: The effectiveness of the repair solution in terms of strength, longevity, and resistance to environmental factors like temperature and weather are crucial determinants of market success.

-

Ease of Application and Cost-Effectiveness: Simple, quick-to-apply repair systems that offer long-term value and minimize downtime for infrastructure are highly sought-after.

-

Regulatory Compliance: Meeting stringent safety and performance standards set by regulatory bodies like ASTM International is essential for widespread adoption.

-

Brand Reputation and Technical Expertise: Established brands with a proven track record and a reputation for delivering reliable solutions hold an edge in a competitive market.

-

Geographical Expansion: Companies with a strong global presence and established distribution networks in emerging markets like Asia Pacific and Latin America have a distinct advantage.

Key Players:

-

Sika AG

-

BASF SE

-

Arkema SA

-

Owens Corning

-

Saint-Gobain S.A.

-

S&P Inc.

-

DuPont de Nemours Inc.

-

Ashland Holdings Inc.

-

Henkel AG & Co.

-

KGaA

-

W.R. Grace & Co.

-

PPG Industries, Inc.

-

Mapei S.p.A.

-

3M Company

-

Fosroc International Limited

-

Dow Inc.

-

RPM International Inc.

-

GCP Applied Technologies Inc.

-

Simpson Strong-Tie Company Inc.

-

Chomarat Group

-

Fiber-Tech Industries Inc.

-

ENECON Corporation

-

Structural Group Inc.

-

Canam Group Inc.

-

Normet Group Oy

-

GFRP Composites Inc.

Recent Developments:

May 2022: Arkema announced its new method for creating composite materials that are recyclable and more effective. The business has been attempting to create environmentally friendly and recyclable chemicals because it wants to live in a sustainable world.

August 2022: V2 Composites, an Australian company that provides carbon fiber-reinforced polymer (CFRP) repair solutions, recently introduced a new and improved carbon fibre T-Biscuit that is anticipated to serve as the go-to method for repairing flange-to-flange shear connections seen in pre-cast double tee beams in parking units.