Market Trends

Key Emerging Trends in the Construction Repair Composites Market

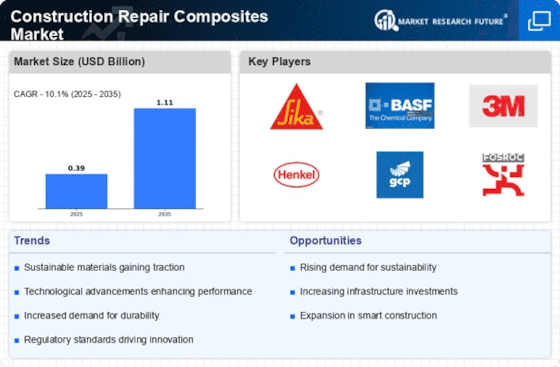

The Construction Repair Composites market is witnessing significant trends driven by the need for durable and cost-effective solutions in the construction and infrastructure repair sector. Growing Emphasis on Infrastructure Rehabilitation: A major trend in the Construction Repair Composites market is the increasing emphasis on infrastructure rehabilitation. Aging infrastructure, including bridges, tunnels, and buildings, requires effective repair and maintenance solutions. Construction repair composites, known for their high strength and durability, are being widely adopted for structural rehabilitation to extend the lifespan of existing infrastructure. Demand for High-Performance Repair Materials: There is a growing demand for high-performance repair materials in the construction industry. Construction repair composites offer properties such as high tensile strength, corrosion resistance, and rapid curing, making them suitable for repairing and strengthening structures. The need for reliable and long-lasting repair solutions is driving the adoption of these composites in various construction projects. Use in Structural Strengthening Applications: Construction repair composites find extensive applications in structural strengthening projects. These composites are used to reinforce and enhance the load-bearing capacity of structures, especially in cases where the original design capacity is insufficient. The versatility of construction repair composites makes them effective for strengthening various types of structures, including concrete and masonry. Advancements in Composite Technologies: Ongoing advancements in composite technologies are shaping the Construction Repair Composites market. Manufacturers are focusing on developing composites with improved characteristics, such as higher flexural strength, enhanced bond strength, and resistance to environmental factors. These technological innovations contribute to the overall efficiency and effectiveness of construction repair composites. Rising Construction Activities in Emerging Economies: The increase in construction activities, particularly in emerging economies, is driving the demand for construction repair composites. As urbanization and infrastructure development projects escalate, there is a growing need for reliable and efficient repair solutions. Construction repair composites offer a cost-effective and durable alternative for addressing structural issues in new and existing constructions. Focus on Sustainable and Environmentally Friendly Solutions: Sustainability is a key trend influencing the Construction Repair Composites market. As the construction industry aligns with environmentally friendly practices, there is a shift towards sustainable repair solutions. Construction repair composites that are eco-friendly, low in VOCs (volatile organic compounds), and contribute to energy efficiency are gaining traction in the market. Technological Integration for Smart Monitoring: The integration of construction repair composites with smart monitoring technologies is an emerging trend. These composites can be embedded with sensors and monitoring devices to provide real-time data on the structural health of repaired buildings or infrastructure. This trend aligns with the broader adoption of smart technologies in the construction industry for predictive maintenance and monitoring. Challenges in Standardization and Certification: Standardization and certification pose challenges for the Construction Repair Composites market. As the industry continues to innovate and introduce new materials and technologies, establishing standardized testing procedures and certifications becomes crucial. Adhering to industry standards enhances the credibility and acceptance of construction repair composites in various applications.

Leave a Comment