Increased Mining Activities

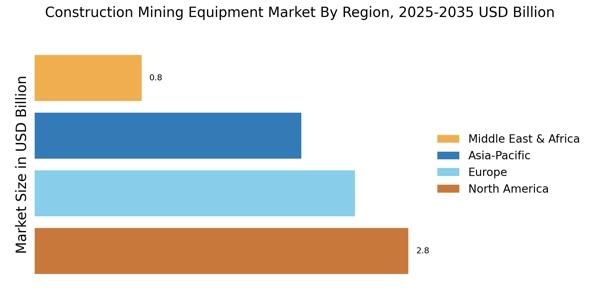

The Construction Mining Equipment Market is also influenced by the rise in mining activities across various regions. As the demand for minerals and resources escalates, mining companies are expanding their operations, necessitating the use of advanced construction mining equipment. The global mining sector is projected to grow at a rate of approximately 4% annually, driven by the need for metals and minerals in various industries, including construction and manufacturing. This growth is likely to result in increased investments in mining equipment, as companies seek to enhance operational efficiency and productivity. Consequently, the Construction Mining Equipment Market stands to gain from this trend, as the need for robust and reliable machinery becomes increasingly critical to meet the demands of the expanding mining sector.

Urbanization and Population Growth

Urbanization and population growth are key drivers of the Construction Mining Equipment Market. As urban areas expand, the demand for housing, infrastructure, and public services increases, necessitating significant construction efforts. This trend is particularly evident in developing regions, where rapid urbanization is leading to a surge in construction projects. According to estimates, urban populations are expected to grow by over 2 billion by 2050, creating a pressing need for construction mining equipment to support these developments. Consequently, construction companies are likely to invest in advanced machinery to meet the rising demand for efficient and effective construction processes. This urbanization trend is anticipated to bolster the Construction Mining Equipment Market, as the need for reliable equipment becomes increasingly critical to accommodate the growing urban landscape.

Technological Innovations in Equipment

Technological advancements are significantly shaping the Construction Mining Equipment Market. Innovations such as automation, telematics, and advanced materials are enhancing the efficiency and safety of construction mining equipment. For example, the integration of IoT technology allows for real-time monitoring of equipment performance, leading to reduced downtime and improved maintenance schedules. Furthermore, the adoption of electric and hybrid machinery is gaining traction, aligning with sustainability goals while offering cost savings in fuel consumption. As a result, the market is witnessing a shift towards more sophisticated and environmentally friendly equipment. This trend is expected to drive growth in the Construction Mining Equipment Market, as companies increasingly prioritize technology to remain competitive and meet evolving regulatory standards.

Rising Demand for Infrastructure Development

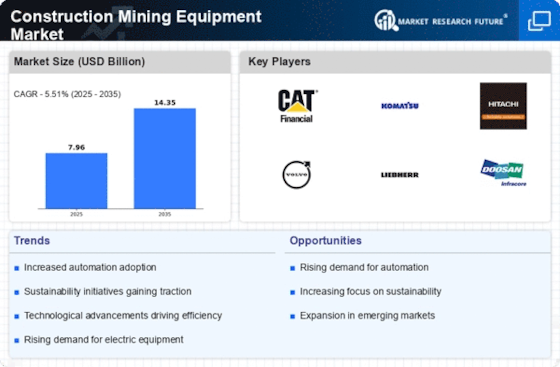

The Construction Mining Equipment Market is experiencing a notable surge in demand driven by extensive infrastructure development projects. Governments and private sectors are increasingly investing in transportation networks, urban development, and energy projects. For instance, the construction of roads, bridges, and railways necessitates advanced mining equipment to ensure efficiency and safety. According to recent data, the infrastructure sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth is likely to stimulate the demand for construction mining equipment, as companies seek to enhance productivity and meet project deadlines. Consequently, the Construction Mining Equipment Market is poised to benefit from this upward trend, as the need for reliable and innovative machinery becomes paramount.

Focus on Sustainability and Environmental Regulations

The Construction Mining Equipment Market is witnessing a shift towards sustainability, driven by stringent environmental regulations and a growing emphasis on eco-friendly practices. Companies are increasingly adopting equipment that minimizes environmental impact, such as low-emission machinery and energy-efficient models. This trend is further supported by government initiatives aimed at reducing carbon footprints and promoting sustainable construction practices. As a result, manufacturers are innovating to produce equipment that meets these regulatory standards while maintaining performance. The market is likely to see a rise in demand for sustainable construction mining equipment, as companies strive to comply with regulations and enhance their corporate social responsibility. This focus on sustainability is expected to play a crucial role in shaping the future of the Construction Mining Equipment Market.