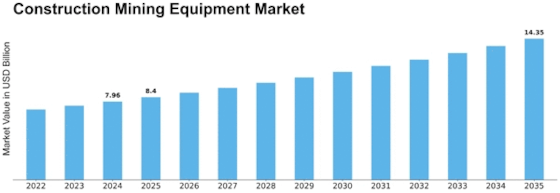

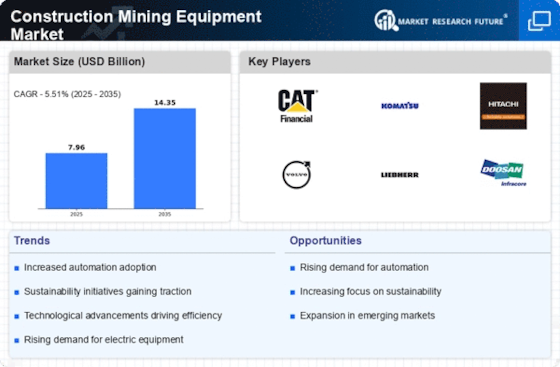

Construction Mining Equipment Size

Construction Mining Equipment Market Growth Projections and Opportunities

The market for construction mining equipment will grow along with the number of infrastructure development projects around the world. Greater investment in construction and the need for efficient tools to speed up projects are driving demand for this equipment." Construction and mining equipment sales are affected by the world economy in a big way. There is a greater need for tools to help build and manage infrastructure when the economy is strong and people are spending more on building projects. Different types of mining tools are needed because the mining business continues to evolve, particularly in how rocks and materials are taken out of the ground. Alterations in the prices of materials and the desire for them all over the world also have an impact on the economic system. Tough rules on emissions and a growing focus on environmentally friendly practices have an impact on the market for building and mining tools. Companies are working hard to make machines that use less fuel and are better for the earth so they can meet these standards and meet the environmental goals of the business. As methods for mining research and production get better, the mining industry needs different kinds of tools. Some of these are better digging, mining, and handling of rock. Limits on imports and exports, taxes, and changes in the way the global supply chain works all have an effect on the market for making mining equipment. These things affect market trends because manufacturers need to keep an eye on them to make sure they have a steady supply of parts and tools. In the business of making and mining tools, it's very important to follow safety rules and what the government says. Safety standards affect both buyer’s and sellers' choices when it comes to tools. This affects the market and how it works. When people rent equipment instead of buying it, it has a direct effect on the market for mining and building machinery. Customers want more flexible options, which changes how companies that make and give out tools run their businesses. It has an impact on the building mining tools business to switch to clean energy and eco-friendly methods. It takes more specialized mining tools to get the minerals that green technologies need. This is in line with the energy change as a whole. Politics and government laws in different places have an impact on the market for building and mining tools. Policies that encourage building new roads, mining, and economic growth all help the market grow. On the other hand, policies that make the government unstable can make people less trusting of the market.

Leave a Comment