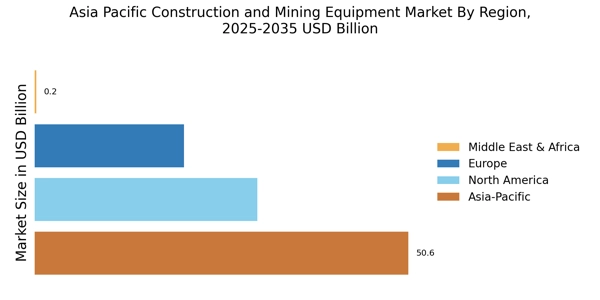

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 1.1 in the APAC construction mining equipment sector, driven by rapid urbanization and infrastructure development. Key growth drivers include government initiatives like the Belt and Road Initiative, which boosts demand for heavy machinery. The consumption pattern is shifting towards advanced, eco-friendly equipment, supported by stringent environmental regulations. The government is also investing heavily in smart city projects, further enhancing market potential.

India : Infrastructure Boom Fuels Demand

India's market share stands at 0.7, reflecting a robust growth trajectory fueled by government initiatives like the National Infrastructure Pipeline. The demand for construction mining equipment is surging, driven by urbanization and increased investment in infrastructure projects. Regulatory policies are becoming more favorable, with incentives for local manufacturing and sustainability initiatives gaining traction. The market is also witnessing a shift towards automation and digitalization in construction processes.

Japan : Focus on Automation and Efficiency

Japan's construction mining equipment market holds a share of 0.4, characterized by a strong emphasis on technological innovation. Key growth drivers include the aging workforce and the need for automation to enhance productivity. Demand trends indicate a shift towards advanced machinery that integrates IoT and AI technologies. Government policies are promoting smart construction practices, aligning with sustainability goals and disaster resilience initiatives.

South Korea : Innovation and Quality Drive Growth

South Korea's market share is 0.3, supported by a competitive landscape that emphasizes quality and innovation. The growth is driven by government investments in infrastructure and smart city projects. Demand for construction mining equipment is increasing, particularly in urban areas like Seoul and Busan. Major players like Doosan Infracore and Volvo are prominent, focusing on high-tech solutions and sustainability, which are crucial in the local market dynamics.

Malaysia : Infrastructure Development on the Rise

Malaysia's construction mining equipment market accounts for 0.15, with growth driven by ongoing infrastructure projects and urban development. The government is implementing policies to enhance local manufacturing and attract foreign investment. Demand trends show a preference for versatile and efficient machinery, particularly in states like Selangor and Penang. The competitive landscape includes both local and international players, with a focus on adapting to market needs and sustainability.

Thailand : Infrastructure Needs Drive Equipment Demand

Thailand's market share is 0.1, with growth influenced by government infrastructure initiatives and foreign investments. The demand for construction mining equipment is rising, particularly in urban centers like Bangkok and Chiang Mai. Regulatory policies are evolving to support local manufacturing and sustainability. The competitive landscape features both domestic and international players, with a focus on adapting to local market dynamics and sector-specific applications in construction and mining.

Indonesia : Infrastructure Development is Key

Indonesia's market share stands at 0.08, with growth potential driven by government infrastructure projects and foreign investments. The demand for construction mining equipment is increasing, particularly in regions like Java and Sumatra. Regulatory policies are becoming more supportive, encouraging local manufacturing and sustainability initiatives. The competitive landscape includes major players like SANY Group and XCMG, focusing on adapting to local market needs and enhancing operational efficiency.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a market share of 0.15, characterized by diverse economic conditions and varying demand for construction mining equipment. Growth drivers include regional infrastructure projects and government initiatives aimed at enhancing local manufacturing. Demand trends vary significantly, influenced by local regulations and market dynamics. The competitive landscape features a mix of local and international players, each adapting to unique regional challenges and opportunities.