Surge in Urbanization

Urbanization is a critical factor impacting the construction mining-equipment market, particularly in the United States. As urban areas expand, the demand for infrastructure development, including roads, bridges, and buildings, increases. This surge in construction activity necessitates the use of advanced mining equipment to meet the growing needs of urban populations. Recent statistics indicate that urban areas are projected to house over 80% of the US population by 2050, leading to a heightened demand for construction services. Consequently, the construction mining-equipment market is likely to benefit from this trend, as companies invest in modern equipment to support urban development.

Rising Demand for Automation

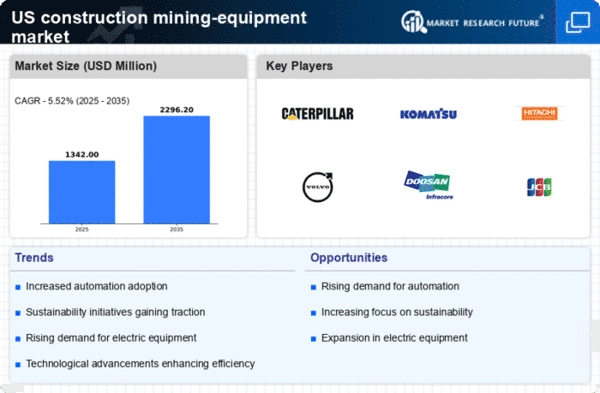

The construction mining-equipment market is experiencing a notable shift towards automation, driven by the need for increased efficiency and reduced labor costs. Automation technologies, such as autonomous vehicles and advanced robotics, are being integrated into construction processes. This trend is expected to enhance productivity and safety on job sites. According to recent data, the market for automated construction equipment is projected to grow at a CAGR of approximately 15% over the next five years. As companies seek to optimize operations, the adoption of automated solutions is likely to become a key driver in the construction mining-equipment market.

Increased Regulatory Compliance

The construction mining-equipment market is significantly influenced by stringent regulatory frameworks aimed at ensuring safety and environmental protection. Regulations concerning emissions, noise levels, and worker safety are becoming more rigorous, compelling manufacturers to innovate and adapt their equipment accordingly. Compliance with these regulations often requires substantial investment in research and development, which can drive up costs. However, companies that successfully navigate these regulations may gain a competitive edge. The market is expected to see a shift towards more eco-friendly and compliant equipment, which could represent a substantial opportunity for growth in the construction mining-equipment market.

Growing Focus on Safety Standards

Safety remains a paramount concern within the construction mining-equipment market, influencing equipment design and operational protocols. The increasing emphasis on worker safety has led to the development of advanced safety features in machinery, such as improved visibility, automatic shut-off systems, and enhanced ergonomics. Companies are investing in training programs and safety certifications to comply with evolving standards. This focus on safety not only protects workers but also reduces liability for companies. As safety regulations become more stringent, the construction mining-equipment market is likely to see a rise in demand for equipment that meets these enhanced safety standards, driving innovation and growth.

Technological Advancements in Equipment

The construction mining-equipment market is witnessing rapid technological advancements that are reshaping the industry landscape. Innovations such as telematics, IoT integration, and machine learning are enhancing equipment performance and operational efficiency. These technologies enable real-time monitoring and predictive maintenance, reducing downtime and operational costs. As a result, companies are increasingly investing in state-of-the-art equipment to remain competitive. The market for technologically advanced construction mining equipment is expected to grow significantly, with estimates suggesting a potential increase of 20% in market value over the next few years. This trend indicates a strong shift towards smarter, more efficient equipment in the construction mining-equipment market.