Rising Demand for Raw Materials

The rising demand for raw materials in France is another critical driver for the construction mining-equipment market. As the construction sector expands, the need for aggregates, metals, and other materials is increasing, necessitating the use of efficient mining equipment. The construction mining equipment market will experience growth as companies invest in machinery that can handle larger volumes and improve extraction processes. Furthermore, with the construction industry projected to grow at a CAGR of 4% through 2026, the demand for mining equipment is likely to follow suit. This trend indicates a strong correlation between construction activity and the need for advanced mining solutions.

Infrastructure Development Surge

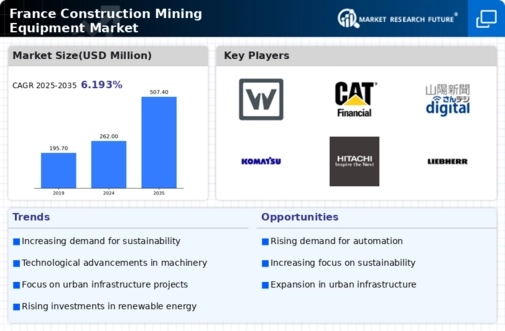

The ongoing surge in infrastructure development in France is a primary driver for the construction mining equipment market. With the government committing to extensive projects, including transportation networks and urban development, the demand for advanced machinery is likely to increase. Reports indicate that the French government allocated approximately €50 billion for infrastructure projects in 2025 alone. This investment is expected to stimulate the construction sector, thereby enhancing the need for various mining equipment. As urbanization continues to rise, the construction mining-equipment market is poised to benefit from the heightened activity in both public and private sectors, suggesting a robust growth trajectory in the coming years.

Investment in Renewable Energy Projects

Investment in renewable energy projects in France is emerging as a significant driver for the construction mining-equipment market. The government's commitment to transitioning towards sustainable energy sources has led to an increase in construction activities related to wind, solar, and hydroelectric power. This shift necessitates specialized mining equipment for the extraction of materials used in renewable energy infrastructure. The construction mining equipment market will see a rise in demand as companies seek to equip themselves with the necessary machinery to support these projects. Analysts suggest that this trend could contribute to a market growth of approximately 12% by 2026, reflecting the increasing importance of sustainability in construction.

Technological Advancements in Equipment

Technological advancements in construction mining equipment are significantly influencing the market landscape in France. Innovations such as automation, telematics, and advanced materials are enhancing the efficiency and safety of machinery. For instance, the integration of IoT technology allows for real-time monitoring and predictive maintenance, which can reduce downtime and operational costs. The construction mining equipment market will see a shift towards electric and hybrid machinery, aligning with environmental regulations and sustainability goals. As companies seek to improve productivity and reduce emissions, the adoption of these advanced technologies may drive market growth, potentially increasing the overall market size by an estimated 15% by 2027.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent in France, impacting the construction mining-equipment market. The government has implemented various regulations aimed at ensuring worker safety and minimizing environmental impact. As a result, construction companies are compelled to invest in modern equipment that meets these standards. This shift not only enhances safety but also improves operational efficiency. The construction mining equipment market will benefit from this trend, as manufacturers develop machinery that complies with the latest regulations. It is estimated that adherence to these standards could lead to a 10% increase in equipment sales over the next few years.