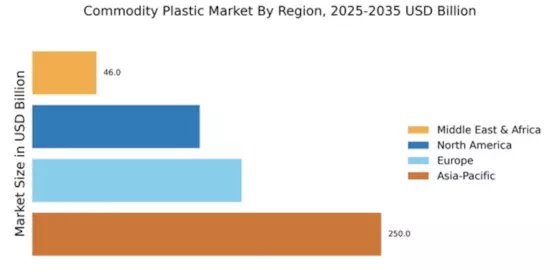

North America : Innovation and Sustainability Focus

The North American commodity plastic market, valued at $120.0 billion, is driven by innovation and sustainability initiatives. Regulatory frameworks are increasingly favoring eco-friendly materials, pushing manufacturers to adopt greener practices. The demand for lightweight and durable plastics in automotive and packaging sectors is also on the rise, contributing to market growth. As companies pivot towards sustainable solutions, the market is expected to see significant advancements in recycling technologies and bioplastics.

Leading the market are the US and Canada, with major players like Dow Chemical Company and ExxonMobil Chemical Company dominating the landscape. The competitive environment is characterized by strategic partnerships and investments in R&D to enhance product offerings. The presence of established firms ensures a robust supply chain, while emerging startups are introducing innovative solutions, further enriching the market dynamics.

Europe : Regulatory Compliance and Innovation

Europe's commodity plastic market, valued at €150.0 billion, is significantly influenced by stringent regulations aimed at reducing plastic waste. The European Union's directives on single-use plastics and recycling targets are driving innovation in sustainable materials. This regulatory landscape is fostering a shift towards biodegradable and recyclable plastics, aligning with consumer demand for environmentally friendly products. The market is expected to grow as companies adapt to these regulations and invest in sustainable practices.

Germany, France, and the UK are leading the market, with key players like BASF SE and LyondellBasell Industries N.V. at the forefront. The competitive landscape is marked by collaborations between industry leaders and research institutions to develop advanced materials. The presence of a well-established manufacturing base and a strong focus on sustainability positions Europe as a leader in The Commodity Plastic.

Asia-Pacific : Emerging Powerhouse in Plastics

The Asia-Pacific region, with a market size of $250.0 billion, is the largest player in the commodity plastic market, driven by rapid industrialization and urbanization. Countries like China and India are experiencing significant demand for plastics in packaging, automotive, and construction sectors. The region's growth is further supported by favorable government policies and investments in infrastructure, which are enhancing production capabilities and supply chain efficiencies.

China stands out as a dominant force, hosting major players like Sinopec and Formosa Plastics Corporation. The competitive landscape is characterized by a mix of local and international companies, all vying for market share. As the region continues to expand, innovations in production processes and materials are expected to play a crucial role in meeting the growing demand for commodity plastics.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa (MEA) commodity plastic market, valued at $45.99 billion, is poised for growth, driven by abundant natural resources and increasing industrial activities. The region is witnessing a surge in demand for plastics in construction, packaging, and consumer goods, fueled by population growth and urbanization. Governments are also investing in petrochemical industries, which is expected to enhance production capacities and attract foreign investments.

Leading countries in the MEA region include Saudi Arabia and South Africa, where companies like SABIC and Ineos Group Limited are key players. The competitive landscape is evolving, with local firms expanding their operations and international companies entering the market. As the region capitalizes on its resource wealth, the commodity plastic market is set to experience significant growth in the coming years.