Increased Demand for Commodities

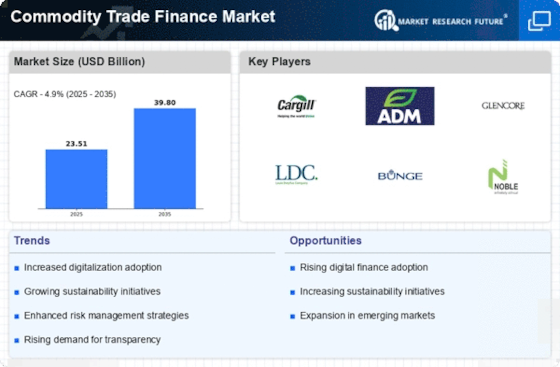

The Commodity Trade Finance Market is currently experiencing heightened demand for various commodities, driven by factors such as population growth and urbanization. As economies expand, the need for raw materials, including metals, agricultural products, and energy resources, intensifies. According to recent data, the global demand for commodities is projected to grow at a compound annual growth rate of approximately 4% over the next five years. This surge in demand necessitates robust financing solutions to facilitate trade, thereby propelling the Commodity Trade Finance Market forward. Financial institutions are increasingly focusing on providing tailored financing options to meet the specific needs of commodity traders, which may further enhance market dynamics.

Geopolitical Tensions and Trade Dynamics

Geopolitical tensions are increasingly impacting the Commodity Trade Finance Market, influencing trade flows and financing strategies. Trade disputes, sanctions, and political instability can disrupt supply chains and create uncertainty in commodity markets. For instance, recent tensions in key commodity-producing regions have led to fluctuations in prices and availability, prompting traders to seek more flexible financing options. Financial institutions are adapting to these changing dynamics by offering products that mitigate risks associated with geopolitical uncertainties. This adaptability is crucial for maintaining liquidity in the Commodity Trade Finance Market, as it allows traders to navigate challenges while ensuring the continuity of trade operations. The interplay between geopolitics and trade finance is likely to shape the future landscape of the market.

Technological Advancements in Trade Finance

Technological innovations are reshaping the Commodity Trade Finance Market, enabling more efficient and transparent transactions. The adoption of blockchain technology, for instance, is streamlining processes by providing secure and immutable records of transactions. Additionally, the integration of artificial intelligence and machine learning is enhancing risk assessment and credit evaluation, allowing financial institutions to make informed decisions. As per industry estimates, the implementation of these technologies could reduce transaction costs by up to 30%, thereby attracting more participants to the Commodity Trade Finance Market. This technological evolution not only improves operational efficiency but also fosters trust among stakeholders, which is crucial for the growth of the market.

Regulatory Changes and Compliance Requirements

The Commodity Trade Finance Market is significantly influenced by evolving regulatory frameworks and compliance requirements. Governments and regulatory bodies are increasingly focusing on enhancing transparency and reducing risks associated with trade financing. Recent regulations aimed at combating money laundering and ensuring ethical sourcing of commodities are reshaping financing strategies. Financial institutions are compelled to adapt their operations to comply with these regulations, which may lead to increased operational costs. However, this also presents an opportunity for the Commodity Trade Finance Market to develop innovative compliance solutions that can streamline processes while ensuring adherence to legal standards. The ability to navigate these regulatory landscapes effectively could provide a competitive advantage.

Sustainability Initiatives in Commodity Trading

Sustainability is becoming a pivotal consideration within the Commodity Trade Finance Market, as stakeholders increasingly prioritize environmentally responsible practices. The demand for sustainable commodities, such as organic agricultural products and ethically sourced metals, is on the rise. Financial institutions are responding by developing green financing solutions that support sustainable trade practices. According to recent reports, the market for green bonds linked to commodity financing is expected to reach USD 100 billion by 2026. This shift towards sustainability not only aligns with global environmental goals but also attracts a new segment of investors who are keen on supporting responsible trading practices. Consequently, the Commodity Trade Finance Market is likely to witness a transformation as sustainability becomes a core component of financing strategies.