Global Supply Chain Resilience

The resilience of The US Commodity Chemicals Industry. Recent disruptions have highlighted the importance of robust supply chain strategies. Companies are increasingly focusing on diversifying their supplier base and investing in local production capabilities to mitigate risks associated with global dependencies. This shift is expected to enhance the stability of supply chains, ensuring a consistent flow of raw materials and reducing lead times. As firms adapt to these changes, the US Commodity Chemicals Market may witness a transformation in sourcing strategies, potentially leading to more localized production and a stronger emphasis on supply chain transparency.

Rising Demand for Eco-Friendly Products

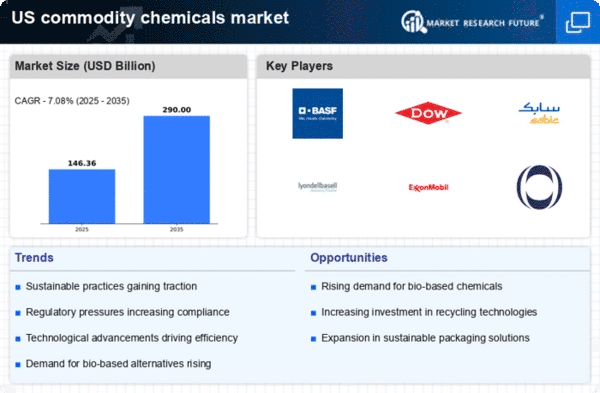

The US Commodity Chemicals Market is experiencing a notable shift towards eco-friendly products, driven by increasing consumer awareness and regulatory pressures. As sustainability becomes a priority, manufacturers are compelled to innovate and develop greener alternatives. This trend is reflected in the growing market for bio-based chemicals, which is projected to reach USD 20 billion by 2026. Companies are investing in research and development to create sustainable solutions, which not only meet consumer demands but also comply with stringent environmental regulations. The transition towards eco-friendly products is likely to reshape the competitive landscape of the US Commodity Chemicals Market, as firms that prioritize sustainability may gain a significant market advantage.

Expanding Applications Across Industries

The versatility of commodity chemicals is driving their expanding applications across various industries, including automotive, construction, and agriculture. The US Commodity Chemicals Market is witnessing a surge in demand for chemicals used in lightweight materials for automotive manufacturing, which is projected to grow at a CAGR of 4.5% through 2025. Additionally, the construction sector's recovery is fueling the need for chemicals in adhesives and sealants. This diversification of applications not only broadens the market scope but also enhances the resilience of the US Commodity Chemicals Market against economic fluctuations, as it caters to multiple sectors.

Regulatory Compliance and Safety Standards

The US Commodity Chemicals Market is increasingly influenced by stringent regulatory compliance and safety standards. Government agencies are implementing more rigorous regulations to ensure environmental protection and worker safety. Companies are required to invest in compliance measures, which may include upgrading facilities and adopting safer production methods. This regulatory landscape can create both challenges and opportunities; while compliance costs may rise, firms that proactively adapt to these regulations can enhance their reputation and market position. The emphasis on safety and compliance is likely to shape strategic decisions within the US Commodity Chemicals Market, as companies seek to align with evolving standards.

Technological Innovations in Production Processes

Technological advancements are playing a crucial role in enhancing the efficiency of production processes within the US Commodity Chemicals Market. Innovations such as automation, artificial intelligence, and advanced analytics are streamlining operations, reducing costs, and improving product quality. For instance, the adoption of AI-driven predictive maintenance can minimize downtime and optimize resource allocation. Furthermore, the integration of digital technologies is enabling companies to respond swiftly to market changes and consumer preferences. As a result, firms that leverage these technologies are likely to enhance their competitive edge, potentially leading to increased market share in the US Commodity Chemicals Market.