Technological Advancements

The Cloud Gaming Market is experiencing rapid technological advancements that enhance user experience and accessibility. Innovations in cloud infrastructure, such as edge computing and 5G networks, are pivotal in reducing latency and improving streaming quality. As of October 2025, the integration of artificial intelligence and machine learning into gaming platforms is likely to personalize user experiences, making games more engaging. Furthermore, advancements in graphics rendering technology enable high-quality visuals without the need for powerful local hardware. This shift towards more sophisticated technology not only attracts gamers but also encourages developers to create more complex and immersive games. The increasing availability of high-speed internet connections further supports the growth of the Cloud Gaming Market, allowing more users to access cloud gaming services seamlessly.

Expansion of Game Libraries

The Cloud Gaming Market is benefiting from the expansion of game libraries offered by various platforms. As of October 2025, many cloud gaming services are partnering with game developers to provide an extensive range of titles, including both classic and newly released games. This diversification of content is crucial in attracting a wider audience, as gamers are increasingly looking for platforms that offer a comprehensive selection of games. The availability of exclusive titles and popular franchises can significantly enhance a service's appeal, potentially leading to increased subscriptions and user engagement. Furthermore, the expansion of game libraries is likely to foster a competitive environment among cloud gaming providers, encouraging innovation and improved service offerings within the Cloud Gaming Market.

Evolving Consumer Preferences

The Cloud Gaming Market is significantly influenced by evolving consumer preferences, particularly among younger demographics. As of October 2025, there is a noticeable shift towards on-demand gaming experiences, where players prefer instant access to a wide variety of games without the need for physical copies. This trend aligns with the increasing popularity of subscription-based models, which offer gamers the flexibility to play multiple titles for a fixed monthly fee. Additionally, consumers are becoming more environmentally conscious, favoring digital solutions over traditional gaming methods that require physical media. This shift in preferences is likely to drive the growth of the Cloud Gaming Market, as it aligns with the desires of a new generation of gamers who prioritize convenience and sustainability.

Rising Demand for Mobile Gaming

The Cloud Gaming Market is witnessing a surge in demand for mobile gaming, driven by the proliferation of smartphones and tablets. As of October 2025, mobile gaming accounts for a substantial portion of the overall gaming market, with estimates suggesting that it could represent over 50% of total gaming revenue. This trend is compelling cloud gaming providers to optimize their services for mobile platforms, ensuring that users can enjoy high-quality gaming experiences on the go. The convenience of mobile gaming, combined with the ability to access a vast library of games without the need for expensive hardware, is likely to attract a broader audience. Consequently, the Cloud Gaming Market is expected to expand as more players engage with cloud-based gaming solutions through their mobile devices.

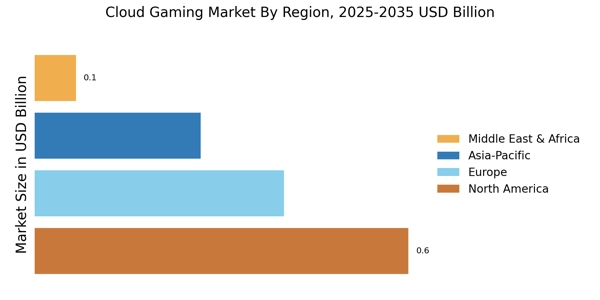

Increased Investment in Cloud Infrastructure

The Cloud Gaming Market is experiencing increased investment in cloud infrastructure, which is essential for supporting the growing demand for gaming services. As of October 2025, major technology companies are allocating substantial resources to enhance their cloud capabilities, focusing on improving server performance and reducing latency. This investment is critical for delivering high-quality gaming experiences, as it allows for smoother gameplay and faster load times. Additionally, the expansion of data centers across various regions is likely to improve accessibility for users, ensuring that more gamers can benefit from cloud gaming services. The ongoing development of robust cloud infrastructure is expected to play a vital role in the future growth of the Cloud Gaming Market, as it lays the foundation for more advanced gaming solutions.