Growing Aging Population

The demographic shift towards an aging population is another significant factor influencing the Clinical Laboratory Test Market. As individuals age, they typically experience a higher incidence of health issues, necessitating more frequent laboratory testing. Projections indicate that by 2030, the number of people aged 65 and older will reach approximately 1.4 billion, which could lead to an increased demand for diagnostic services. This demographic trend suggests that clinical laboratories will play a crucial role in managing the health of older adults, thereby driving growth in the Clinical Laboratory Test Market. The need for routine screenings and monitoring of age-related conditions is likely to further bolster this market.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer appears to be a primary driver for the Clinical Laboratory Test Market. As these conditions require regular monitoring and management, the demand for laboratory tests is likely to rise. According to recent statistics, chronic diseases account for approximately 70% of all deaths, underscoring the necessity for effective diagnostic tools. This trend suggests that healthcare providers are increasingly relying on clinical laboratory tests to guide treatment decisions and improve patient outcomes. Consequently, the Clinical Laboratory Test Market is expected to experience substantial growth as healthcare systems adapt to the rising burden of chronic diseases.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare, which is significantly impacting the Clinical Laboratory Test Market. As healthcare systems shift from reactive to proactive approaches, the demand for routine laboratory tests is expected to rise. Preventive screenings and early detection of diseases can lead to better health outcomes and reduced healthcare costs. Reports indicate that investments in preventive care can save healthcare systems billions annually. This trend suggests that clinical laboratories will increasingly be utilized for preventive measures, thereby driving growth in the Clinical Laboratory Test Market. The integration of laboratory tests into routine health assessments is likely to become more commonplace.

Technological Innovations in Diagnostics

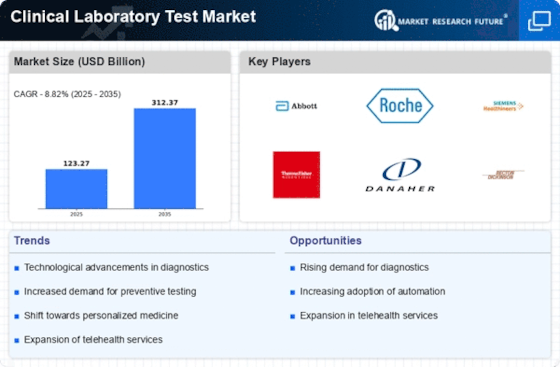

Technological advancements in diagnostic tools and methodologies are transforming the Clinical Laboratory Test Market. Innovations such as next-generation sequencing, automated analyzers, and point-of-care testing devices are enhancing the accuracy and efficiency of laboratory tests. These technologies not only improve diagnostic capabilities but also reduce turnaround times, which is critical in clinical settings. The market for laboratory automation is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years. This trend indicates that as technology continues to evolve, the Clinical Laboratory Test Market will likely expand, driven by the demand for more sophisticated and rapid testing solutions.

Regulatory Support for Laboratory Testing

Regulatory frameworks supporting laboratory testing are also contributing to the growth of the Clinical Laboratory Test Market. Governments and health organizations are recognizing the importance of laboratory diagnostics in disease management and public health. Initiatives aimed at improving laboratory standards and accessibility are being implemented, which may enhance the reliability of test results. Furthermore, regulatory bodies are increasingly approving new tests and technologies, facilitating market entry for innovative solutions. This supportive environment suggests that the Clinical Laboratory Test Market will continue to thrive as regulatory measures promote the adoption of advanced diagnostic tools and methodologies.