Rising Incidence of Chronic Diseases

The clinical laboratory-test market in South America is experiencing growth due to the rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer. As these conditions become more prevalent, there is an increasing demand for diagnostic tests that can aid in early detection and management. According to recent data, chronic diseases account for approximately 70% of all deaths in the region, highlighting the urgent need for effective laboratory testing. This trend is likely to drive investments in clinical laboratories, as healthcare providers seek to enhance their testing capabilities. Furthermore, the growing awareness among the population regarding the importance of regular health check-ups is expected to further boost the clinical laboratory-test market.

Rising Health Awareness and Education

The clinical laboratory-test market in South America is being positively influenced by rising health awareness and education among the population. As individuals become more informed about health issues and the importance of regular testing, there is a growing demand for laboratory services. Educational campaigns and community health initiatives are playing a pivotal role in promoting preventive healthcare practices. This shift in mindset is likely to result in an increase in the utilization of clinical laboratory tests, as people seek to monitor their health proactively. Market projections suggest that this trend could lead to a 20% increase in laboratory test requests over the next few years, thereby significantly impacting the clinical laboratory-test market.

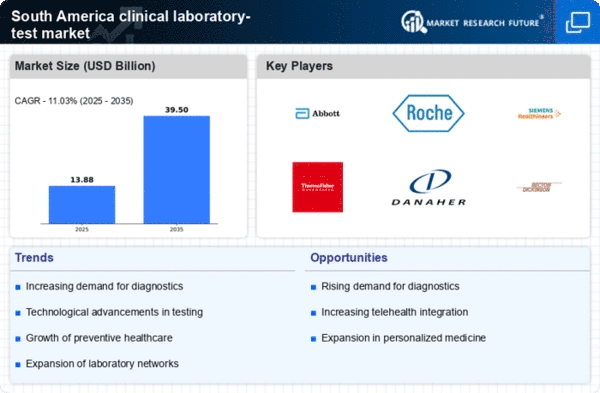

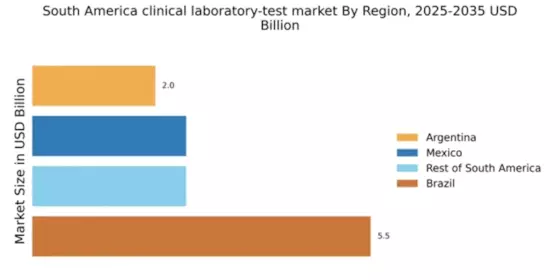

Expansion of Healthcare Infrastructure

the clinical laboratory-test market is benefiting from the expansion of healthcare infrastructure across various countries. Governments and private entities are investing significantly in building new hospitals and laboratories, which enhances access to diagnostic services. For instance, Brazil and Argentina have initiated several projects aimed at modernizing healthcare facilities, which is likely to increase the availability of clinical laboratory tests. This expansion is projected to lead to a compound annual growth rate (CAGR) of around 8% in the clinical laboratory-test market over the next five years. Improved infrastructure not only facilitates better testing services but also encourages the adoption of advanced technologies, thereby enhancing the overall quality of healthcare in the region.

Growing Demand for Point-of-Care Testing

the clinical laboratory-test market is witnessing a shift towards point-of-care testing (POCT), driven by the need for rapid and accurate diagnostic results. POCT allows for immediate testing and results, which is particularly beneficial in remote areas where access to traditional laboratory services may be limited. The convenience and efficiency of POCT are appealing to both healthcare providers and patients, leading to an increase in its adoption. Market analysis indicates that the POCT segment could account for approximately 30% of the clinical laboratory-test market by 2026. This trend reflects a broader movement towards decentralized healthcare solutions, which are likely to reshape the landscape of laboratory testing in South America.

Increased Investment in Research and Development

the clinical laboratory-test market is experiencing a surge in investment in research and development (R&D). This focus on R&D is crucial for the development of innovative diagnostic tests and technologies that can address the unique health challenges faced by the region. Governments and private companies are collaborating to enhance the capabilities of clinical laboratories, which is expected to lead to the introduction of new testing methodologies. For example, advancements in molecular diagnostics and genetic testing are gaining traction, potentially transforming the clinical laboratory-test market landscape. It is estimated that R&D spending in this sector could increase by 15% annually, reflecting a commitment to improving healthcare outcomes through advanced laboratory testing.