Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Italy play a crucial role in the clinical laboratory-test market. Increased funding for healthcare services, particularly in diagnostics, is fostering an environment conducive to innovation and expansion. The Italian government has allocated substantial resources to enhance laboratory capabilities, which includes upgrading equipment and expanding testing services. Such initiatives not only improve access to diagnostic testing but also encourage collaboration between public and private sectors. As a result, the clinical laboratory-test market is likely to benefit from enhanced service delivery and improved health outcomes for the population.

Integration of Advanced Technologies

The integration of advanced technologies into the clinical laboratory-test sector is transforming the landscape of diagnostic testing in Italy. Innovations such as artificial intelligence, automation, and molecular diagnostics are enhancing the accuracy and efficiency of laboratory tests. For instance, the adoption of AI-driven analytics is enabling laboratories to process large volumes of data swiftly, leading to quicker turnaround times for test results. This technological evolution not only improves operational efficiency but also elevates the quality of patient care. As laboratories invest in these technologies, they are likely to gain a competitive edge in the clinical laboratory-test market, attracting more healthcare providers and patients.

Rising Demand for Diagnostic Testing

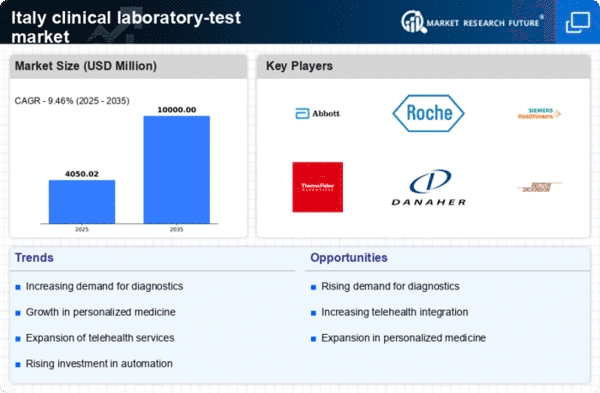

The clinical laboratory-test sector in Italy experiences a notable increase in demand for diagnostic testing. This trend is driven by a growing awareness of health issues among the population, leading to more individuals seeking preventive and routine health check-ups. According to recent data, the market is projected to grow at a CAGR of approximately 6.5% over the next five years. This growth is indicative of a shift towards proactive healthcare management, where early detection of diseases is prioritized. As a result, clinical laboratories are expanding their testing capabilities to meet this rising demand, thereby enhancing their service offerings and improving patient outcomes.

Aging Population and Chronic Diseases

Italy's aging population significantly impacts the clinical laboratory-test market, as older adults typically require more frequent medical testing. The prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is on the rise, necessitating regular monitoring and diagnostic testing. Data indicates that approximately 23% of the Italian population is over 65 years old, a demographic that often relies heavily on laboratory services. This trend underscores the importance of clinical laboratories in managing chronic health conditions, thereby driving growth in the market. As healthcare systems adapt to cater to this demographic, the demand for specialized laboratory tests is expected to increase.

Growing Public Awareness of Health Issues

There is a marked increase in public awareness regarding health issues in Italy, which is positively influencing the clinical laboratory-test market. Educational campaigns and health initiatives are encouraging individuals to take charge of their health, leading to a rise in the number of people seeking laboratory tests for early detection of diseases. This heightened awareness is reflected in the increasing participation in health screenings and preventive tests. As more individuals recognize the importance of regular health assessments, clinical laboratories are positioned to experience growth in test volumes. This trend suggests a shift towards a more health-conscious society, which could further drive the demand for laboratory services.