Regulatory and Reimbursement Changes

Regulatory and reimbursement changes are shaping the landscape of the US Clinical Laboratory Test Market. Recent updates in healthcare policies and reimbursement models are influencing how laboratory tests are ordered, performed, and compensated. For instance, the implementation of value-based care models encourages laboratories to demonstrate the clinical utility of their tests. This shift may lead to increased scrutiny of laboratory services, compelling clinical laboratories to enhance their quality and efficiency. Additionally, changes in reimbursement rates for certain tests can impact laboratory revenues, prompting them to adapt their business strategies. As the regulatory environment continues to evolve, laboratories must remain agile to navigate these challenges effectively. The US Clinical Laboratory Test Market is thus likely to experience fluctuations as it responds to ongoing regulatory and reimbursement developments.

Rising Prevalence of Chronic Diseases

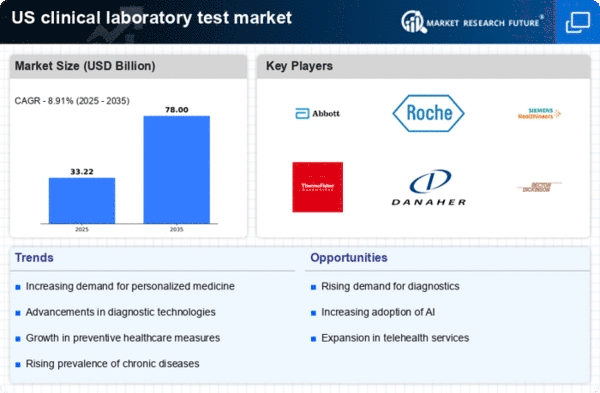

The increasing prevalence of chronic diseases in the United States is a primary driver of the US Clinical Laboratory Test Market. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming more common, necessitating regular testing and monitoring. According to the Centers for Disease Control and Prevention, approximately 6 in 10 adults in the US have a chronic disease, which underscores the demand for laboratory tests. This trend is likely to continue, as the aging population further contributes to the rise in chronic conditions. Consequently, clinical laboratories are expanding their testing capabilities to meet the growing needs of healthcare providers and patients. The US Clinical Laboratory Test Market is thus positioned for growth as healthcare systems increasingly rely on laboratory tests for diagnosis, treatment, and management of these diseases.

Advancements in Diagnostic Technologies

Technological advancements in diagnostic testing are significantly influencing the US Clinical Laboratory Test Market. Innovations such as molecular diagnostics, next-generation sequencing, and point-of-care testing are enhancing the accuracy and speed of laboratory results. For instance, the market for molecular diagnostics is projected to reach USD 11.5 billion by 2026, reflecting a compound annual growth rate of 10.5%. These advancements not only improve patient outcomes but also streamline laboratory operations, making them more efficient. As healthcare providers increasingly adopt these technologies, the demand for sophisticated laboratory tests is expected to rise. This trend indicates a robust future for the US Clinical Laboratory Test Market, as laboratories invest in cutting-edge technologies to remain competitive and meet evolving healthcare demands.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is driving the US Clinical Laboratory Test Market. As healthcare systems shift from reactive to proactive approaches, there is a heightened demand for routine screenings and diagnostic tests. Preventive measures, such as early detection of diseases, are crucial in reducing healthcare costs and improving patient outcomes. The US Preventive Services Task Force recommends various screenings, which has led to an increase in laboratory test utilization. This trend is likely to continue, as both patients and providers recognize the value of preventive care. Consequently, clinical laboratories are expanding their test offerings to include a wider range of preventive screenings, thereby enhancing their role in the healthcare continuum. The US Clinical Laboratory Test Market stands to benefit from this shift towards preventive healthcare, as it aligns with broader public health goals.

Growing Demand for Home Testing Solutions

The rising demand for home testing solutions is emerging as a significant driver of the US Clinical Laboratory Test Market. With advancements in technology, patients are increasingly seeking convenient and accessible testing options that can be performed in the comfort of their homes. This trend is reflected in the growing popularity of at-home testing kits for various conditions, including diabetes, cholesterol levels, and infectious diseases. The convenience of home testing not only empowers patients but also alleviates pressure on clinical laboratories. As a result, laboratories are adapting their services to accommodate this shift, offering more home testing options and ensuring accurate results. The US Clinical Laboratory Test Market is poised for growth as it embraces this trend, catering to the evolving preferences of patients and healthcare providers.