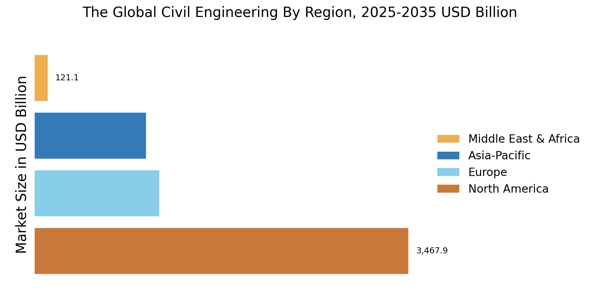

By Region, the study segments the market into North America, Europe, Asia-Pacific, and Rest of the World. North America Civil Engineering Market accounted for USD 1643.32 billion in 2021 and is expected to exhibit an 5.2% CAGR during the study period. Increasing investments in infrastructure and construction projects by major market players, as well as economic growth in the United States, are among the primary reasons driving corporate expansion. Furthermore, the continual construction of sewerage networks throughout major North American urban centers will accelerate the market landscape even further.

Further, the major countries studied are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe Civil Engineering Market accounts for the second-largest market share due to the rising demand for faster, smarter, and affordable building process in the developed countries such as Germany, France, and the U.K. is witnessing high growth rates. Europe is projected to observe significant amount of growth in the civil engineering market due to the strict VOC emission rules during construction are expected to boost demand for precast/prefabricated building products in Europe.

Over the forecast period, the introduction of new materials, such as construction additives and eco-friendly building materials, is likely to generate profitable prospects for market participants in the civil engineering uses sector. Further, the Germany Civil Engineering Market held the largest market share, and the UK Civil Engineering Market was the fastest growing market in the European region.

The Asia-Pacific Civil Engineering Market led the market and accounted for more than 23% of worldwide revenue in 2022 because of the availability of low-cost labor in markets like as China, India, and others. Due to increased demand for industrial and commercial development, the regional market will expand further at a stable growth rate of the civil engineering sector throughout the projection period. Moreover, China Civil Engineering Market held the largest market share, and the India Civil Engineering Market was the fastest growing market in the Asia-Pacific region.

For instance, India Civil Engineering Market expected to grow very rapidly. The construction industry's recovery, as well as growing increasing consumer disposable income levels in, are fueling the rise of the Civil Engineering industry in India. China is expected to emerge as the region's market leader however, nations such as India, Australia, Indonesia, and Thailand are expected to provide fresh construction and refurbishment projects. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.