Regulatory Framework Enhancements

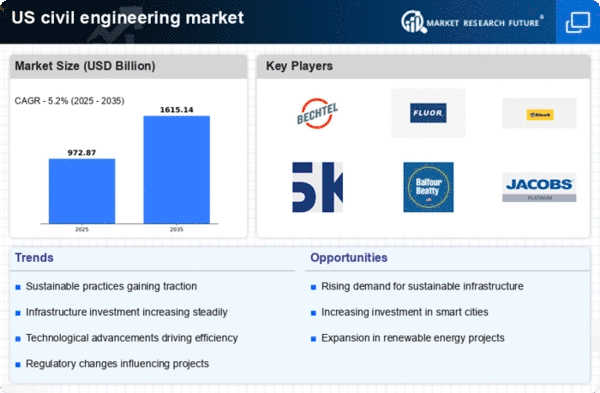

The civil engineering market is currently influenced by evolving regulatory frameworks that aim to improve safety and sustainability. Recent legislation has mandated stricter compliance with environmental standards, which has led to increased demand for innovative engineering solutions. For instance, the implementation of the Infrastructure Investment and Jobs Act has allocated approximately $1.2 trillion for infrastructure improvements, significantly impacting the civil engineering market. This funding is expected to enhance project scopes and increase the need for skilled labor and advanced materials. As regulations continue to tighten, firms that adapt to these changes may gain a competitive edge, thereby driving growth in the civil engineering market.

Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are becoming a vital mechanism for financing infrastructure projects in the civil engineering market. These collaborations allow for shared investment and risk management, enabling the execution of large-scale projects that might otherwise be unfeasible. The U.S. government has recognized the potential of PPPs, leading to an increase in their implementation across various sectors, including transportation and utilities. By leveraging private sector expertise and funding, public entities can expedite project delivery and enhance service quality. This trend is likely to drive growth in the civil engineering market as more projects are realized through these partnerships.

Urbanization and Population Growth

Urbanization trends in the United States are contributing to a robust demand for civil engineering services. As more individuals migrate to urban areas, the need for infrastructure development, including transportation systems, housing, and utilities, becomes increasingly critical. The U.S. Census Bureau projects that by 2030, approximately 80% of the population will reside in urban settings. This demographic shift necessitates substantial investment in civil engineering projects to accommodate growing populations. Consequently, the civil engineering market is poised for expansion as municipalities seek to enhance their infrastructure to support urban growth and improve quality of life.

Technological Advancements in Construction

Technological advancements are reshaping the civil engineering market, introducing innovative methodologies that enhance efficiency and reduce costs. The integration of Building Information Modeling (BIM), drones, and 3D printing is revolutionizing project planning and execution. According to industry reports, the adoption of these technologies can lead to cost savings of up to 20% on construction projects. As firms increasingly leverage these tools, they are likely to improve project timelines and quality, thereby attracting more clients. This trend indicates a shift towards a more technology-driven civil engineering market, where firms that embrace innovation may outperform their competitors.

Sustainability Initiatives and Green Building

Sustainability initiatives are increasingly influencing the civil engineering market, as stakeholders prioritize environmentally friendly practices. The demand for green building materials and sustainable construction methods is on the rise, driven by both regulatory requirements and consumer preferences. According to the U.S. Green Building Council, the green building market is projected to reach $1 trillion by 2030. This shift towards sustainability not only enhances the environmental footprint of projects but also opens new avenues for civil engineering firms to innovate. As the market evolves, companies that prioritize sustainability may find themselves at a competitive advantage, thereby shaping the future of the civil engineering market.