Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are emerging as a vital mechanism for financing civil engineering projects in China. These collaborations between government entities and private firms are designed to leverage private sector expertise and capital for public infrastructure development. The civil engineering market stands to benefit from this model, as it can facilitate the completion of large-scale projects that may otherwise face funding challenges. With the government encouraging PPPs, there is a growing trend of private investment in infrastructure, which could enhance the efficiency and quality of civil engineering projects. This approach may also lead to innovative solutions and improved service delivery in the civil engineering market.

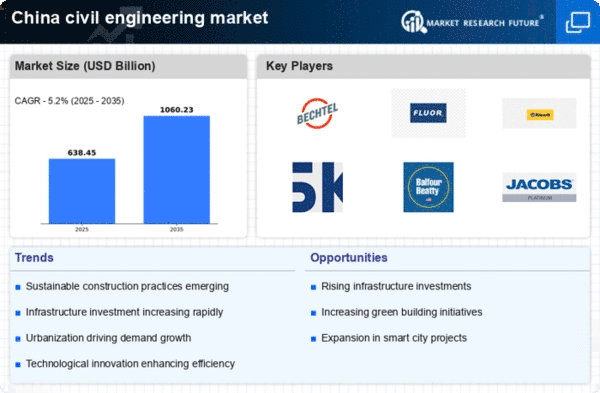

Urbanization and Population Growth

China's rapid urbanization continues to be a significant driver for the civil engineering market. With over 60% of the population now residing in urban areas, the demand for housing, transportation, and public amenities is escalating. The urban population is projected to reach 1 billion by 2030, necessitating extensive civil engineering projects to accommodate this growth. This trend is likely to result in increased investments in residential and commercial construction, as well as infrastructure development. The civil engineering market must adapt to the challenges posed by urban sprawl, ensuring that projects are sustainable and meet the needs of a growing urban populace.

Government Infrastructure Investment

The civil engineering market in China is experiencing a surge in government investment aimed at enhancing infrastructure. The Chinese government has allocated approximately $1 trillion for infrastructure projects over the next five years, focusing on transportation, energy, and urban development. This investment is expected to stimulate economic growth and create numerous job opportunities within the civil engineering sector. The emphasis on modernizing existing infrastructure and constructing new facilities is likely to drive demand for civil engineering services. Furthermore, the government's commitment to improving public services and connectivity indicates a robust pipeline of projects, which could lead to a sustained growth trajectory for the civil engineering market.

Technological Advancements in Construction

The civil engineering market in China is witnessing a transformation due to technological advancements. Innovations such as Building Information Modeling (BIM), 3D printing, and smart construction techniques are enhancing project efficiency and reducing costs. The integration of these technologies is expected to improve project delivery timelines and quality, thereby attracting more investments into the civil engineering sector. As companies adopt these advanced methodologies, the market could see a shift towards more sustainable practices, aligning with global trends. The potential for increased productivity and reduced waste may further bolster the civil engineering market's growth in the coming years.

Environmental Regulations and Sustainability Initiatives

The civil engineering market in China is influenced by stringent environmental regulations and sustainability initiatives. The government has implemented policies aimed at reducing carbon emissions and promoting eco-friendly construction practices. This shift towards sustainability is likely to drive demand for green building materials and energy-efficient designs. As a result, civil engineering firms may need to invest in new technologies and training to comply with these regulations. The emphasis on sustainable development could reshape project planning and execution, potentially leading to a more resilient civil engineering market that prioritizes environmental stewardship.