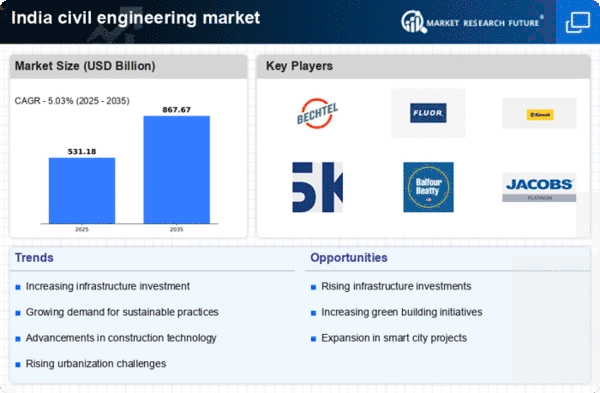

Urbanization and Population Growth

The rapid urbanization in India is a primary driver of the civil engineering market. With an estimated urban population growth rate of around 2.3% annually, cities are expanding, necessitating extensive infrastructure development. This includes residential, commercial, and transportation projects. The demand for housing alone is projected to require approximately 10 million new units by 2030. Additionally, the increasing population density in urban areas leads to a greater need for public utilities and services, such as water supply, sewage systems, and road networks. Consequently, civil engineering firms are likely to experience heightened demand for innovative solutions to address these challenges, thereby propelling the civil engineering market forward.

Rising Demand for Smart Infrastructure

The demand for smart infrastructure is emerging as a significant driver in the civil engineering market. With the advent of smart city initiatives, there is a growing need for integrated systems that enhance urban living. This includes smart transportation systems, energy-efficient buildings, and advanced waste management solutions. The Indian government has allocated substantial funds for the development of 100 smart cities, which could lead to an estimated investment of $30 billion. As these projects progress, civil engineering firms will need to adapt to new technologies and methodologies, positioning themselves to capitalize on the opportunities presented by this shift towards smarter urban environments.

Government Investment in Infrastructure

Government initiatives play a crucial role in shaping the civil engineering market in India. The government has committed to investing over $1 trillion in infrastructure development over the next five years, focusing on transportation, energy, and urban development. This investment is expected to create numerous opportunities for civil engineering firms, as projects such as highways, railways, and smart cities are prioritized. Furthermore, the National Infrastructure Pipeline aims to facilitate the development of 7,000 projects, which could significantly boost the civil engineering market. As these projects unfold, the demand for skilled labor and advanced materials will likely increase, further stimulating market growth.

Technological Advancements in Construction

Technological advancements are transforming the civil engineering market in India. The integration of Building Information Modeling (BIM), drones, and 3D printing is enhancing project efficiency and accuracy. For instance, BIM allows for better planning and management of construction projects, reducing costs by up to 20%. Additionally, the use of drones for site surveys and inspections is becoming increasingly common, providing real-time data and improving safety. These innovations not only streamline processes but also contribute to sustainable practices by minimizing waste. As technology continues to evolve, civil engineering firms that adopt these advancements are likely to gain a competitive edge in the market.

Sustainability and Green Building Practices

Sustainability is becoming a pivotal focus within the civil engineering market in India. The growing awareness of environmental issues has led to an increased demand for green building practices. The Indian Green Building Council reports that the green building footprint is expected to reach 10 billion sq ft by 2022, indicating a substantial shift towards eco-friendly construction. This trend is driven by both regulatory requirements and consumer preferences for sustainable living spaces. Civil engineering firms that prioritize sustainable materials and energy-efficient designs are likely to find new opportunities in this evolving market landscape, as clients increasingly seek to reduce their carbon footprint.