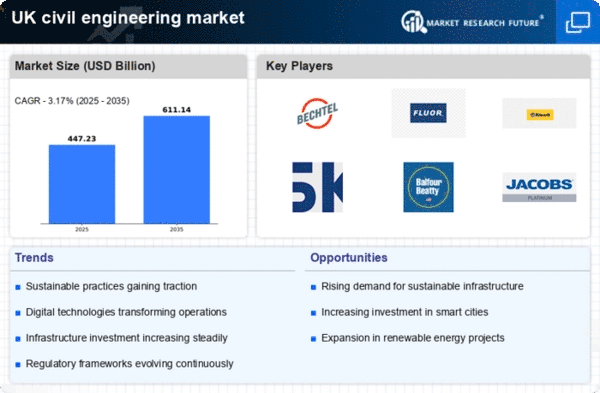

Infrastructure Investment Surge

The civil engineering market in the UK is currently experiencing a notable surge in infrastructure investment, driven by government initiatives aimed at enhancing public services and transportation networks. The UK government has allocated approximately £100 billion for infrastructure projects over the next five years, which is expected to stimulate growth within the civil engineering market. This investment focuses on upgrading roads, bridges, and rail systems, thereby creating numerous job opportunities and fostering economic development. Additionally, the emphasis on modernizing existing infrastructure to meet contemporary standards is likely to further propel demand for civil engineering services. As a result, firms within the civil engineering market are poised to benefit from increased project opportunities and a more robust pipeline of work, which may lead to enhanced profitability and market expansion.

Regulatory Framework Enhancements

The civil engineering market in the UK is influenced by ongoing enhancements in regulatory frameworks that govern construction and engineering practices. Recent updates to building regulations and environmental standards are designed to ensure safety, sustainability, and efficiency in construction projects. These regulations often require civil engineering firms to adopt innovative practices and technologies, which can lead to increased operational costs but also present opportunities for differentiation in the market. Compliance with these regulations is essential for firms seeking to secure contracts, as clients increasingly prioritize adherence to safety and environmental standards. Consequently, The civil engineering market is likely to shift towards more sustainable and compliant practices. This shift may enhance the reputation and competitiveness of firms that effectively navigate these regulatory changes.

Urbanization and Population Growth

Urbanization and population growth in the UK are driving significant demand within the civil engineering market. As cities expand and populations increase, the need for new housing, transportation, and public infrastructure becomes more pressing. The Office for National Statistics projects that the UK population will reach approximately 70 million by 2030, necessitating substantial investment in civil engineering projects to accommodate this growth. This trend is particularly evident in metropolitan areas, where the demand for residential and commercial developments is surging. Civil engineering firms are thus presented with opportunities to engage in large-scale projects that address these urban challenges, potentially leading to increased revenues and market share. The ability to deliver innovative solutions that meet the needs of growing urban populations will be crucial for success in the civil engineering market.

Focus on Resilience and Climate Adaptation

The civil engineering market in the UK is increasingly focusing on resilience and climate adaptation in response to the growing impacts of climate change. As extreme weather events become more frequent, there is a pressing need for infrastructure that can withstand such challenges. The UK government has recognized this need and is investing in projects aimed at enhancing the resilience of critical infrastructure, such as flood defenses and transportation networks. This focus on climate adaptation is likely to create new opportunities for civil engineering firms that specialize in designing and implementing resilient solutions. By prioritizing sustainability and resilience, the civil engineering market can not only address immediate challenges but also contribute to long-term environmental goals, positioning firms for future success in an evolving landscape.

Technological Advancements in Construction

Technological advancements are reshaping the civil engineering market in the UK, with innovations such as Building Information Modeling (BIM), drones, and 3D printing becoming increasingly prevalent. These technologies enhance project efficiency, reduce costs, and improve accuracy in construction processes. For instance, the adoption of BIM allows for better collaboration among stakeholders, leading to fewer errors and delays. The UK government has been actively promoting the use of digital technologies in construction, which is likely to drive further investment in these areas. As firms in the civil engineering market embrace these advancements, they may gain a competitive edge by delivering projects more efficiently and effectively. This technological shift not only improves project outcomes but also aligns with the industry's broader goals of sustainability and innovation.