Market Growth Projections

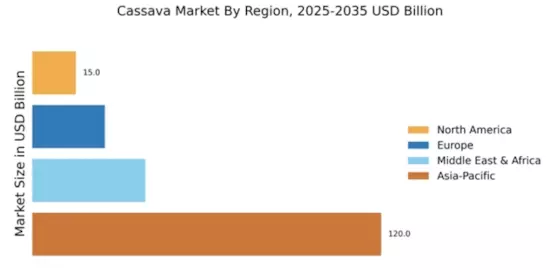

The Global cassava Industry is poised for substantial growth, with projections indicating a market value of 198.9 USD Billion in 2024 and an anticipated increase to 312.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.18% from 2025 to 2035, reflecting the increasing global demand for cassava products. Factors contributing to this growth include rising consumer awareness of health benefits, technological advancements in processing, and supportive government policies. As the market evolves, stakeholders are likely to explore innovative applications for cassava, further enhancing its appeal and market presence.

Rising Demand for Cassava-Based Products

The Global Cassava Industry experiences a notable increase in demand for cassava-based products, driven by their versatility and nutritional benefits. Cassava Market is utilized in various forms, including flour, starch, and chips, appealing to both food and non-food sectors. The growing trend towards gluten-free diets further propels this demand, as cassava flour serves as a suitable alternative. In 2024, the market value is projected to reach 198.9 USD Billion, reflecting a robust consumer preference for healthier options. This trend is likely to continue, with projections indicating a market expansion to 312.2 USD Billion by 2035, highlighting the potential for sustained growth in the Global Cassava Industry.

Emerging Markets and Export Opportunities

Emerging markets present substantial opportunities for the Global Cassava Industry, as demand for cassava products continues to rise in regions such as Asia and Africa. These markets are increasingly recognizing the economic potential of cassava cultivation, leading to expanded production and export capabilities. Countries like Nigeria and Thailand are already significant players in the global cassava trade, exporting products to various international markets. As global consumption patterns shift, the potential for growth in these regions is considerable, with projections indicating a compound annual growth rate of 4.18% from 2025 to 2035. This growth underscores the importance of cassava as a strategic crop in global agricultural trade.

Government Support and Policy Initiatives

Government support plays a crucial role in the growth of the Global Cassava Industry. Various countries have implemented policies aimed at promoting cassava cultivation and processing, recognizing its potential as a staple food and cash crop. Initiatives such as subsidies for farmers, investment in research and development, and infrastructure improvements contribute to increased production capacity. For instance, in several African nations, government programs focus on enhancing agricultural practices and providing access to markets. These efforts not only bolster local economies but also position cassava as a key player in food security strategies, thereby fostering a favorable environment for market expansion.

Growing Awareness of Nutritional Benefits

The Global Cassava Industry benefits from an increasing awareness of the nutritional advantages associated with cassava consumption. Rich in carbohydrates and essential vitamins, cassava is recognized as a vital source of energy, particularly in developing regions. As consumers become more health-conscious, the demand for nutrient-dense foods rises, positioning cassava favorably in the market. This trend is particularly evident in regions where cassava serves as a staple food, contributing to dietary diversity. The emphasis on nutrition is likely to drive further interest in cassava-based products, thereby supporting the market's growth trajectory over the next decade.

Technological Advancements in Cassava Processing

Technological innovations in cassava processing significantly enhance efficiency and product quality within the Global Cassava Industry. Advanced processing techniques, such as improved drying and milling technologies, allow for better preservation of nutrients and extended shelf life of cassava products. These advancements not only increase yield but also reduce waste, making cassava processing more sustainable. As a result, producers can meet the growing global demand while maintaining profitability. The integration of automation and digital technologies in processing facilities is expected to further streamline operations, potentially leading to a more competitive market landscape in the coming years.