Rising Demand for Biofuels

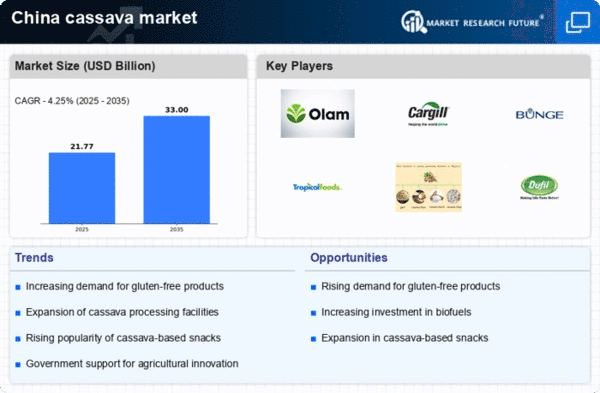

The growing interest in renewable energy sources, particularly biofuels, is emerging as a potential driver for the cassava market in China. Cassava, being a high-yielding crop, is increasingly recognized for its potential in bioethanol production. The Chinese government has set ambitious targets for renewable energy, which may lead to an increased focus on cassava as a feedstock for biofuels. Current estimates suggest that the biofuel sector could expand by 10% annually, with cassava playing a pivotal role in meeting these targets. This trend indicates a dual benefit for the cassava market, as it not only diversifies the applications of cassava but also aligns with national energy policies aimed at reducing carbon emissions.

Expansion of Export Markets

The cassava market in China is likely to benefit from the expansion of export opportunities. As global demand for cassava products increases, particularly in regions such as Southeast Asia and Africa, Chinese producers may find new markets for their goods. Recent data suggests that exports of cassava products from China have risen by approximately 20% in the last year, indicating a growing international interest. This trend could encourage local farmers and producers to invest in cassava cultivation, thereby enhancing the overall capacity of the cassava market. Additionally, the establishment of trade agreements may further facilitate access to international markets, potentially boosting the economic viability of cassava production in China.

Growing Health Consciousness

The increasing awareness of health and nutrition among consumers in China appears to be driving the cassava market. As more individuals seek gluten-free and low-calorie alternatives, cassava, known for its high carbohydrate content and versatility, is gaining traction. The market for cassava-based products, such as flour and snacks, is projected to expand significantly, with estimates suggesting a growth rate of approximately 8% annually. This trend indicates a shift towards healthier eating habits, which could potentially enhance the demand for cassava in various food applications. Furthermore, the cassava market is likely to benefit from the rising popularity of plant-based diets, as cassava serves as a suitable ingredient for vegan and vegetarian products.

Technological Advancements in Agriculture

Innovations in agricultural practices and technology are likely to play a crucial role in enhancing the productivity of cassava cultivation in China. The adoption of precision farming techniques, improved seed varieties, and advanced pest management strategies may lead to higher yields and better quality produce. Reports indicate that the average yield of cassava in China has increased by approximately 15% over the past few years due to these advancements. Such improvements not only support the cassava market by ensuring a steady supply but also contribute to the overall sustainability of agricultural practices. As farmers become more adept at utilizing technology, the cassava market could experience a significant boost in both production and profitability.

Increased Investment in Research and Development

Investment in research and development (R&D) within the cassava market is becoming increasingly vital. As stakeholders recognize the potential of cassava as a versatile crop, funding for R&D initiatives is likely to increase. This investment may focus on improving crop resilience, developing new processing techniques, and enhancing the nutritional profile of cassava products. Recent reports indicate that R&D funding in the agricultural sector has seen a rise of approximately 12% in China, which could directly benefit the cassava market. By fostering innovation, the industry may witness the introduction of novel products and applications, thereby expanding its market reach and enhancing competitiveness.