Growing Focus on Energy Efficiency

The increasing emphasis on energy efficiency in automotive design is a significant driver for the Automotive Magnet Wire Market. As consumers and manufacturers alike prioritize sustainability, the demand for magnet wire that enhances energy efficiency is on the rise. In 2025, it is projected that vehicles equipped with energy-efficient technologies will dominate the market, leading to a heightened need for advanced magnet wire solutions. This trend is likely to encourage manufacturers to invest in high-performance magnet wire that minimizes energy losses in electric motors. Consequently, the Automotive Magnet Wire Market is expected to benefit from this shift towards energy-efficient automotive technologies, as it aligns with broader sustainability goals.

Increase in Electric Vehicle Production

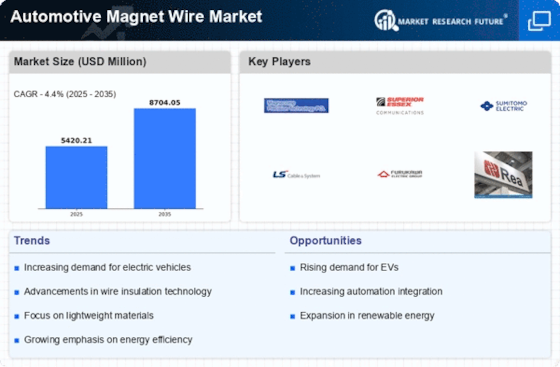

The surge in electric vehicle production is a primary driver for the Automotive Magnet Wire Market. As manufacturers pivot towards electric mobility, the demand for efficient and high-performance magnet wire escalates. In 2025, it is estimated that electric vehicles will account for a substantial share of total vehicle sales, potentially reaching 30%. This shift necessitates advanced magnet wire solutions that enhance motor efficiency and reduce energy losses. Consequently, automotive manufacturers are increasingly investing in high-quality magnet wire to meet the performance standards required for electric drivetrains. The Automotive Magnet Wire Market is thus poised for growth, driven by the need for innovative wire solutions that support the evolving landscape of electric mobility.

Regulatory Support for Electric Mobility

Regulatory frameworks promoting electric mobility are emerging as a crucial driver for the Automotive Magnet Wire Market. Governments worldwide are implementing stringent emissions regulations and providing incentives for electric vehicle adoption. These policies are expected to catalyze the growth of the electric vehicle market, which in turn drives the demand for high-quality magnet wire. By 2025, it is anticipated that several regions will have established comprehensive support systems for electric vehicle infrastructure, including charging stations and manufacturing incentives. This regulatory environment is likely to create a favorable landscape for the Automotive Magnet Wire Market, as manufacturers align their production capabilities with the increasing demand for electric vehicles.

Technological Innovations in Wire Manufacturing

Technological advancements in wire manufacturing processes are significantly influencing the Automotive Magnet Wire Market. Innovations such as improved insulation materials and enhanced wire drawing techniques are leading to the production of lighter and more efficient magnet wires. These advancements not only improve the performance of electric motors but also contribute to overall vehicle efficiency. In 2025, the market is expected to witness a rise in the adoption of these advanced manufacturing technologies, which could lead to a projected growth rate of around 5% annually. As automotive manufacturers seek to optimize their vehicle designs, the demand for technologically superior magnet wire is likely to increase, further propelling the Automotive Magnet Wire Market.

Expansion of Automotive Manufacturing in Emerging Markets

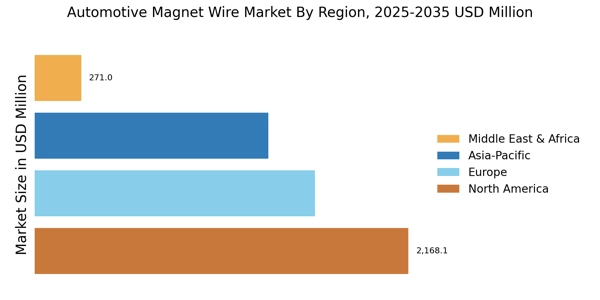

The expansion of automotive manufacturing in emerging markets is poised to drive growth in the Automotive Magnet Wire Market. Countries with developing automotive sectors are increasingly investing in local production capabilities, which is likely to boost the demand for magnet wire. By 2025, it is expected that several emerging economies will experience a rise in vehicle production, particularly in the electric vehicle segment. This growth presents opportunities for magnet wire manufacturers to establish partnerships with local automotive producers. As these markets mature, the Automotive Magnet Wire Market may witness increased competition and innovation, further enhancing the overall market landscape.