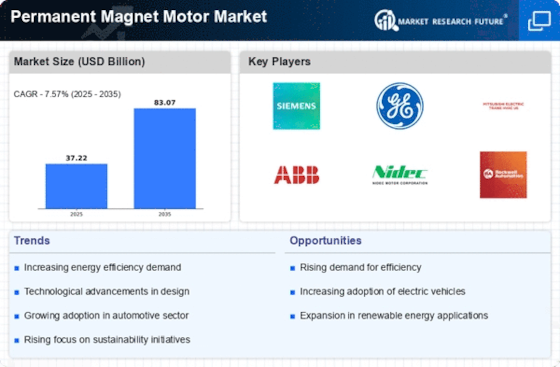

The Permanent Magnet Motor Market has been witnessing significant developments, with companies like Siemens, ABB, and Bosch actively innovating and expanding their product portfolios. Recent advancements in electric vehicle (EV) technologies have bolstered the demand for efficient permanent magnet motors, leading to increased investments in R&D by major players such as Johnson Electric and Rockwell Automation. Furthermore, the integration of Industry 4.0 practices has prompted companies like Emerson Electric and Parker Hannifin to focus on smart motor systems, enhancing automation and operational efficiency.

In recent months, Mitsubishi Electric announced plans to enhance its permanent magnet technology offerings to cater to the booming EV market. Additionally, Regal Beloit has unveiled new motor solutions aimed at improving sustainability and energy efficiency. On the M&A front, Nidec's acquisition of various small motor companies reflects the trend towards consolidation in the market, enhancing its competitive position. Overall, the growing electrification and automation trends are fostering a positive outlook for the market, driving both innovation and strategic collaborations among the key players, including General Electric and Maxon Motor, further affecting valuations in the sector.

In October 2023, Ara Partners, a private equity firm, bought Vacuumschmelze (VAC) - a German producer of permanent magnets – from Apollo. This means that Ara replaces Apollo as an investor in VAC. This deal will enhance the partnership's rare earth value chain and enable the latter to capitalize on its strategy of supplying permanent magnets for electric vehicles (EV) to dominant industries.

In March 2022, Dexter Magnetic Technologies increased its production outputs as well as the square footage of its manufacturing plants. This enables them to make a bigger difference in the semiconductor, defense, and medical industries with their essential devices.

In April 2023, Arnold Magnetic Technologies formed a new partnership with Cyclic Materials. The goal is to come up with a rare earth component cycling method so as to fortify the supply chain of rare substances.

In July 2024, Electron Energy Corporation entered into a partnership with Magnetic Holdings, LLC, in order to first tap the market with exceptional and all-encompassing samarium cobalt magnetics formulations for diverse applications.

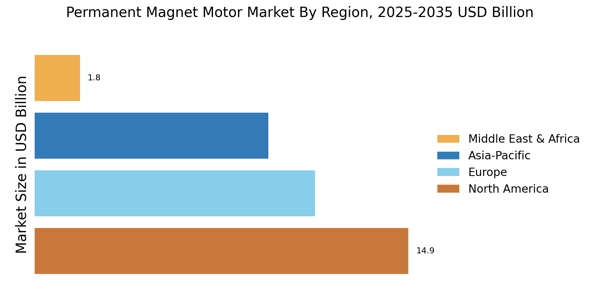

In October 2024, Arnold Magnetic Technologies added additional structures to their production site in Thailand to facilitate the creation of different permanent magnet assemblies. This serves a broader scope of clientele all over the Asia-Pacific, Europe, and the USA.

In January 2023, VAC entered an agreement with American automaker General Motors to construct a manufacturing facility for permanent magnets in North America that will utilize locally sourced material. This was to be used for electric motors in GM vehicles.

In March 2021, Arnold Magnetic Technologies diversified its marketing by acquiring advanced electric motor solutions provider Ramco Electric Motors for industrial, military and aerospace markets.

In July 2022, GKN Powder Metallurgy, a company that deals with the powder metal industry, penetrated the markets for permanent magnets for electric vehicles. An investment is being considered to set up a plant by 2024 to produce 4,000 tons of permanent magnets per year for the EV market.