Market Share

Automotive Magnet Wire Market Share Analysis

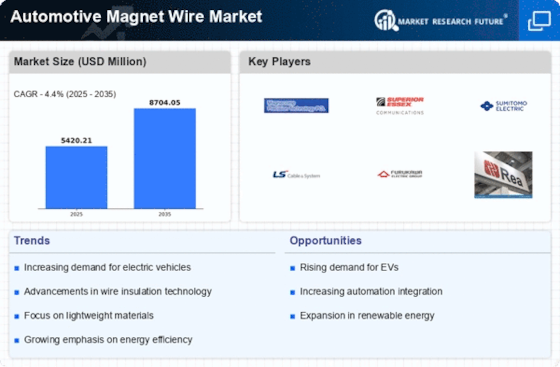

While the Automotive Magnet Wire Market is highly competitive, various enterprises utilize different business approaches to create their unwavering position in the market and to achieve their objectives. Market leadership requires the implementation of strategies where ongoing innovation in magnet wire technologies, formulations, and applications are key factors. Magnet wires in automotive applications is key especially in electric vehicles (EV) that spurns the need for electrical conductivity, thermal resistance and durability as key factors. The automotive magnet wires are a subject of wide research and development involving enhancements in performance efficiency and sustainability of the wires to meet the growing demands of automotive manufacturing and the electric vehicles industry.

Pricing technique in automotive magnet wire positioning is of paramount importance in Automotive Magnet Wire Market. Some companies choose the basic principle of the cost leadership and magnet wires offered at the competitive prices to most range the automotive industry. On the other side, companies with focus on superior formulations, high heat conductivity, or particular coatings for car-specific use, often choose to leverage their advanced technology and thus promote pricing premium strategies. This special approach enables us to lock in customers who pay a premium when seeking superior products which in turn have a multiplier effect on profit margins and, thus, consumers perceive added value.

It is paramount for a company to set up a fast distribution system in order to compete effectively and gain share in the market. Automotive manufacturers and suppliers work together with the traction magnet wire manufacturers to make a widely distributed product. A well planned distribution infrastructure, in addition to widening market accessibility, also guarantees that those who use it in the manufacturing of electric motors, generators or vehicle electrical systems among others, access its component needs freely and easily. Accessibility among the criteria that affect purchase decision making, and therefore, companies strive, to position themselves in that market and cater for that demand adequately.

Strategic partnerships and cooperation with the key players both in the automotive and electric vehicle industries, the supplementary segment of the Automotive Magnet Wire Market share positioning also remains vital. Via partnership arrangements with electric vehicle manufacturers as well as electric magnet makers and makers of electrical system components, magnet wire producers can merge knowledge and expertise, penetrate new markets and be at the fore front of tackling matters surrounding standards, regulations, and continuous market changes that may affect specifications. Joint work, consolidated ventures and strategic acquisitions play a fairly bigger role in a company’s market share and overall positioning in Automotive Magnet Wire Market.

Leave a Comment