Rise of Electric Vehicles

The Automotive Industry is currently experiencing a notable shift towards electric vehicles (EVs), driven by increasing consumer demand for sustainable transportation options. In 2025, EV sales accounted for approximately 15% of total vehicle sales, a figure that is projected to rise significantly in the coming years. This transition is largely influenced by government incentives and regulations aimed at reducing carbon emissions. As automakers invest heavily in EV technology, the Automotive Industry is likely to witness a surge in innovation, including advancements in battery technology and charging infrastructure. The growing awareness of climate change and the need for cleaner alternatives further propels this trend, suggesting that the Automotive Industry will continue to evolve in favor of electric mobility.

Advancements in Autonomous Driving

The Automotive Industry is on the brink of a revolution with the advancements in autonomous driving technology. Companies are investing billions in research and development to create vehicles that can operate without human intervention. As of early 2026, several manufacturers have begun testing Level 4 autonomous vehicles in controlled environments, indicating a potential shift in how consumers perceive vehicle ownership and transportation. The integration of artificial intelligence and machine learning into automotive systems is expected to enhance safety and efficiency, potentially reducing traffic accidents significantly. This trend may reshape urban planning and mobility solutions, suggesting that the Automotive Industry is poised for transformative changes in the near future.

Emerging Markets and Consumer Demand

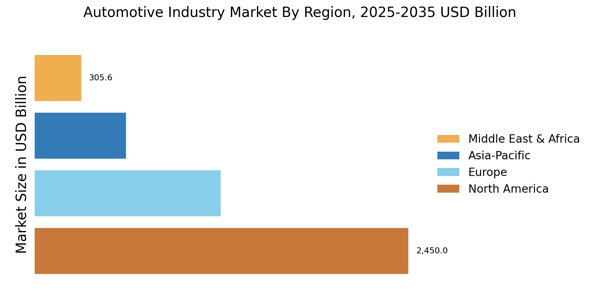

The Automotive Industry is experiencing growth in emerging markets, where rising disposable incomes and urbanization are driving demand for vehicles. Countries in Asia and Africa are witnessing a surge in vehicle ownership, with sales in these regions projected to increase by over 20% by 2030. This trend is fueled by a growing middle class that seeks personal mobility solutions. As manufacturers expand their presence in these markets, they are likely to tailor their offerings to meet local preferences and needs. The Automotive Industry must navigate challenges such as infrastructure development and regulatory environments, but the potential for growth in these regions suggests a dynamic shift in the global automotive landscape.

Increased Connectivity and Smart Features

The Automotive Industry is witnessing a surge in connectivity and smart features, as vehicles become more integrated with digital technologies. The implementation of Internet of Things (IoT) solutions allows for real-time data exchange between vehicles and infrastructure, enhancing the driving experience. In 2025, it was estimated that over 60% of new vehicles were equipped with advanced connectivity features, such as infotainment systems and driver assistance technologies. This trend is likely to continue, as consumers increasingly demand seamless integration with their digital lives. The Automotive Industry is adapting to these expectations by incorporating features that enhance safety, convenience, and entertainment, suggesting a future where vehicles are not just modes of transport but also connected devices.

Sustainability Initiatives and Regulations

The Automotive Industry is increasingly influenced by sustainability initiatives and regulatory frameworks aimed at reducing environmental impact. Governments worldwide are implementing stricter emissions standards, compelling manufacturers to innovate and adopt greener technologies. In 2025, it was reported that nearly 30% of automotive companies had committed to achieving carbon neutrality by 2030. This shift towards sustainability is not only a response to regulatory pressures but also a reflection of changing consumer preferences, as buyers become more environmentally conscious. The Automotive Industry is likely to see a rise in the production of hybrid and alternative fuel vehicles, indicating a broader commitment to sustainable practices and a reduction in the carbon footprint.