Economic Factors

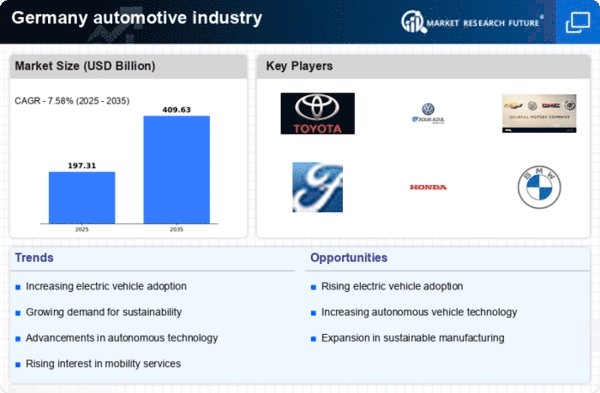

Economic factors play a crucial role in influencing the automotive industry market in Germany. The country's robust economy, characterized by a high GDP per capita, supports strong consumer purchasing power. In 2025, the automotive sector is projected to contribute approximately €400 billion to the national economy, underscoring its significance. However, fluctuations in raw material prices and supply chain disruptions can pose challenges for manufacturers. Additionally, interest rates and inflation rates impact consumer financing options, which in turn affect vehicle sales. As such, economic conditions are likely to remain a key driver in shaping the automotive industry market dynamics.

Consumer Preferences

Consumer preferences are evolving rapidly within the automotive industry market in Germany, driven by a growing awareness of environmental issues and technological advancements. Surveys indicate that approximately 70% of German consumers are willing to consider purchasing an electric vehicle, reflecting a significant shift in attitudes towards sustainability. Additionally, the demand for connected and smart vehicles is on the rise, with features such as advanced driver-assistance systems becoming increasingly desirable. This shift in consumer behavior is prompting manufacturers to diversify their product offerings and invest in innovative technologies, thereby reshaping the competitive landscape of the automotive industry market.

Regulatory Compliance

Regulatory compliance is a critical factor shaping the automotive industry market in Germany. The European Union has implemented stringent regulations regarding vehicle emissions and safety standards, compelling manufacturers to adapt their offerings. By 2025, it is anticipated that compliance costs could account for up to 15% of total production expenses for automotive companies. This regulatory landscape not only influences product development but also drives innovation as companies seek to meet or exceed these standards. Consequently, the automotive industry market is witnessing a shift towards cleaner technologies and enhanced safety features, as manufacturers strive to align with evolving regulations.

Technological Innovation

Technological innovation remains a pivotal driver in the automotive industry market in Germany. The integration of advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) is transforming vehicle design and functionality. In 2025, it is estimated that over 50% of vehicles sold will feature some form of connected technology, enhancing user experience and safety. Furthermore, the push for autonomous driving capabilities is prompting significant investments in research and development. Major automotive players are collaborating with tech firms to develop smart vehicles, which could potentially revolutionize transportation. This ongoing technological evolution is likely to redefine competitive dynamics within the automotive industry market.

Sustainability Initiatives

The automotive industry market in Germany is increasingly influenced by sustainability initiatives aimed at reducing carbon emissions. The German government has set ambitious targets to achieve climate neutrality by 2045, which has led to a surge in demand for electric vehicles (EVs). In 2025, EVs are projected to account for approximately 30% of new car registrations, reflecting a significant shift in consumer preferences. This transition is supported by various incentives, including subsidies for EV purchases and investments in charging infrastructure. As a result, manufacturers are compelled to innovate and adapt their production processes to align with these sustainability goals, thereby reshaping the automotive industry market landscape.