Environmental Regulations and Standards

The automotive market in Canada is increasingly influenced by stringent environmental regulations and standards aimed at reducing greenhouse gas emissions. The Canadian government has set ambitious targets to cut emissions from the transportation sector by 40% by 2030. These regulations are compelling manufacturers to innovate and develop cleaner technologies, including hybrid and fully electric vehicles. Compliance with these standards is not merely a legal obligation; it is becoming a competitive necessity. As a result, the automotive industry market is likely to see a rise in the production of low-emission vehicles, with estimates suggesting that by 2026, 50% of new vehicles sold will meet these stringent environmental criteria. This regulatory landscape is shaping the future of vehicle design and manufacturing in Canada.

Government Incentives for Electric Vehicles

The automotive market in Canada is currently experiencing a surge in government incentives aimed at promoting electric vehicle (EV) adoption. These incentives, which can include rebates and tax credits, are designed to reduce the upfront costs associated with purchasing EVs. As of 2025, the Canadian government has allocated approximately $300 million to support EV infrastructure development, which is expected to enhance consumer confidence and stimulate market growth. This financial backing is crucial as it encourages manufacturers to invest in EV technology, thereby increasing the variety of models available to consumers. Consequently, the automotive industry market is likely to see a significant uptick in EV sales, potentially reaching 30% of total vehicle sales by 2030, as consumers become more aware of the long-term savings associated with electric vehicles.

Growth of Ride-Sharing and Mobility Services

The automotive market in Canada is experiencing a transformation due to the growth of ride-sharing and mobility services. Companies like Uber and Lyft have changed consumer perceptions of vehicle ownership, leading to a decline in personal vehicle sales in urban areas. As of November 2025, it is estimated that ride-sharing services account for approximately 10% of all vehicle miles traveled in major Canadian cities. This shift is prompting automakers to rethink their business models, focusing on partnerships with mobility service providers. The automotive industry market may see an increase in the production of vehicles specifically designed for ride-sharing, which could lead to a more sustainable urban transportation ecosystem. This trend not only impacts sales but also influences vehicle design, emphasizing durability and efficiency.

Shift Towards Autonomous Driving Technologies

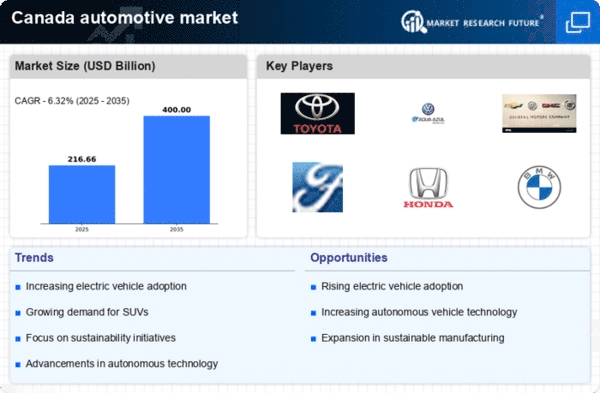

The automotive market in Canada is witnessing a notable shift towards the integration of autonomous driving technologies. This trend is driven by advancements in artificial intelligence and machine learning, which are enhancing vehicle safety and efficiency. As of November 2025, several Canadian provinces are actively testing autonomous vehicles on public roads, with the aim of establishing regulatory frameworks that support their widespread adoption. The potential for reduced traffic accidents and improved traffic flow could lead to a transformation in urban mobility. Market Research Future suggest that by 2035, autonomous vehicles may account for up to 15% of all vehicles on Canadian roads, fundamentally altering the landscape of the automotive industry market. This shift not only presents opportunities for manufacturers but also raises questions about infrastructure readiness and consumer acceptance.

Rising Consumer Demand for Connectivity Features

In the automotive market, there is an increasing consumer demand for connectivity features in vehicles. As technology evolves, consumers are seeking vehicles equipped with advanced infotainment systems, smartphone integration, and real-time navigation capabilities. Data indicates that approximately 60% of Canadian consumers prioritize connectivity when purchasing a new vehicle. This trend is prompting manufacturers to invest heavily in research and development to enhance in-car technology. The automotive industry market is likely to see a proliferation of connected vehicles, with projections suggesting that by 2027, over 70% of new vehicles sold in Canada will feature some form of connectivity. This shift not only enhances the driving experience but also opens new avenues for data monetization and customer engagement.