Expansion of Charging Infrastructure

The expansion of charging infrastructure is a critical factor influencing the Automotive Battery Market. As the number of electric vehicles on the road increases, the need for accessible and efficient charging solutions becomes paramount. Investments in charging networks are being made by both public and private sectors, aiming to alleviate range anxiety among consumers. In 2025, it is projected that the number of charging stations will increase significantly, facilitating the widespread adoption of electric vehicles. This development is likely to enhance the attractiveness of electric vehicles, thereby driving demand for automotive batteries. The Automotive Battery Market stands to benefit from this infrastructure growth, as it supports the overall ecosystem necessary for the successful integration of electric vehicles into everyday life.

Government Incentives and Regulations

The Automotive Battery Market is significantly influenced by government policies and regulations aimed at promoting sustainable transportation. Many countries are implementing stringent emissions regulations and offering incentives for electric vehicle adoption, which directly impacts battery demand. For example, tax credits and rebates for EV purchases are becoming increasingly common, encouraging consumers to transition to electric vehicles. Additionally, regulations mandating the reduction of greenhouse gas emissions are pushing automakers to invest in advanced battery technologies. As a result, the Automotive Battery Market is likely to benefit from these supportive measures, fostering an environment conducive to growth and innovation in battery production and technology.

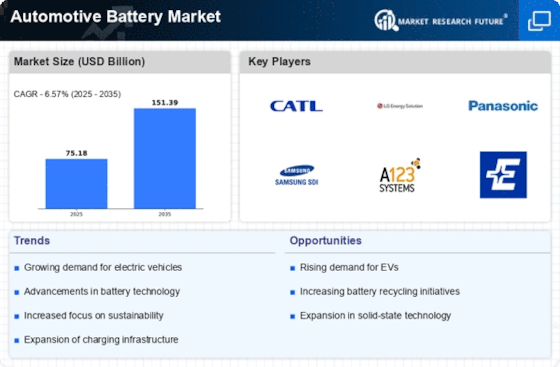

Increasing Demand for Electric Vehicles

The Automotive Battery Market is experiencing a notable surge in demand, primarily driven by the increasing adoption of electric vehicles (EVs). As consumers become more environmentally conscious, the shift towards EVs is accelerating. In 2025, it is estimated that the sales of electric vehicles will account for approximately 30% of total vehicle sales. This transition necessitates advanced battery technologies, which are crucial for enhancing vehicle range and performance. Consequently, the Automotive Battery Market is poised for substantial growth, as manufacturers strive to meet the rising demand for high-capacity batteries that support longer driving ranges and faster charging times. The competition among battery manufacturers is intensifying, leading to innovations that could further enhance battery efficiency and sustainability.

Technological Advancements in Battery Technology

Technological innovations are playing a pivotal role in shaping the Automotive Battery Market. Recent advancements in battery chemistry, such as solid-state batteries and lithium-sulfur technologies, are expected to revolutionize the market. These innovations promise to deliver higher energy densities, improved safety, and reduced charging times. For instance, solid-state batteries could potentially double the energy capacity compared to traditional lithium-ion batteries, making them a game-changer for electric vehicles. As research and development efforts continue, the Automotive Battery Market is likely to witness a wave of new products that enhance performance and sustainability. This technological evolution not only addresses consumer demands but also aligns with the broader industry trend towards electrification.

Rising Consumer Awareness of Environmental Issues

Consumer awareness regarding environmental sustainability is a driving force behind the growth of the Automotive Battery Market. As individuals become more informed about the environmental impact of traditional fossil fuel vehicles, there is a growing preference for electric vehicles equipped with advanced battery systems. This shift in consumer behavior is prompting automakers to prioritize the development of eco-friendly vehicles, which in turn drives demand for high-performance batteries. The Automotive Battery Market is responding to this trend by focusing on sustainable battery production methods and recycling initiatives. This heightened awareness not only influences purchasing decisions but also encourages manufacturers to adopt greener practices throughout the supply chain.